The CEO Radar Q3 2025

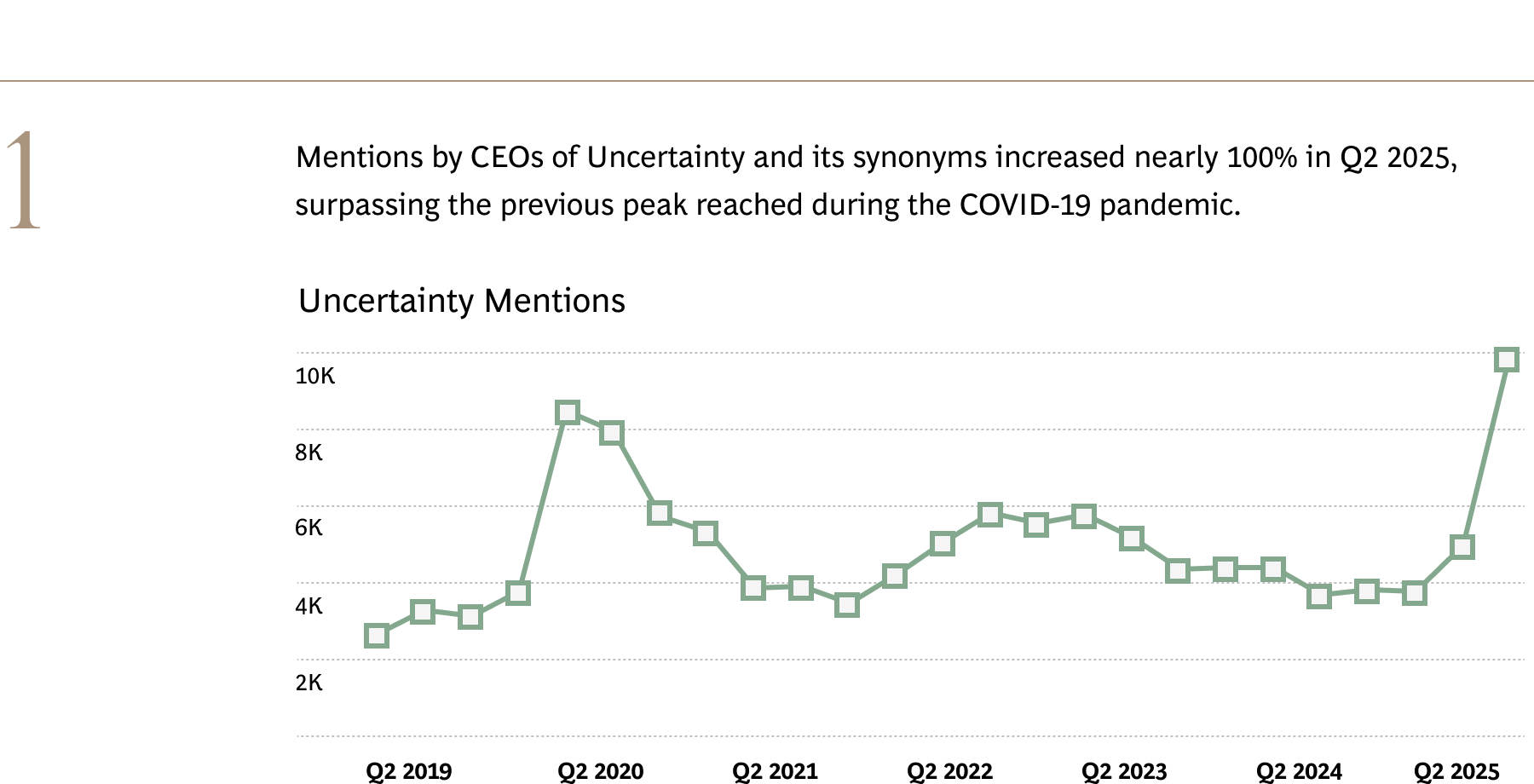

While discussions of US tariff policies dominated Q2 earnings calls to an unprecedented degree, another equally important trend is bubbling just under the surface in C-suites and on trading floors: concern that the economic uncertainty caused by tariff turmoil may lead to a downturn.

That’s the key finding of the third edition of the CEO Radar, an AI-powered analysis from BCG and Bloomberg Media Studios of more than 4,500 quarterly earnings calls worldwide. The study also found:

The CEO Radar is a tool designed to help CEOs determine which issues truly deserve their time and attention. In this edition, we analyzed 4,573 earnings calls worldwide from Q2 2025, covering roughly 300 topics.

At this year’s midpoint, the view is decidedly cloudy from both the executive suite and Wall Street, with few observers willing to predict where things will stand when 2025 ends.

The clearest signal of uncertainty is CEOs’ discussions of Tariffs—by far the leading topic of the quarter.

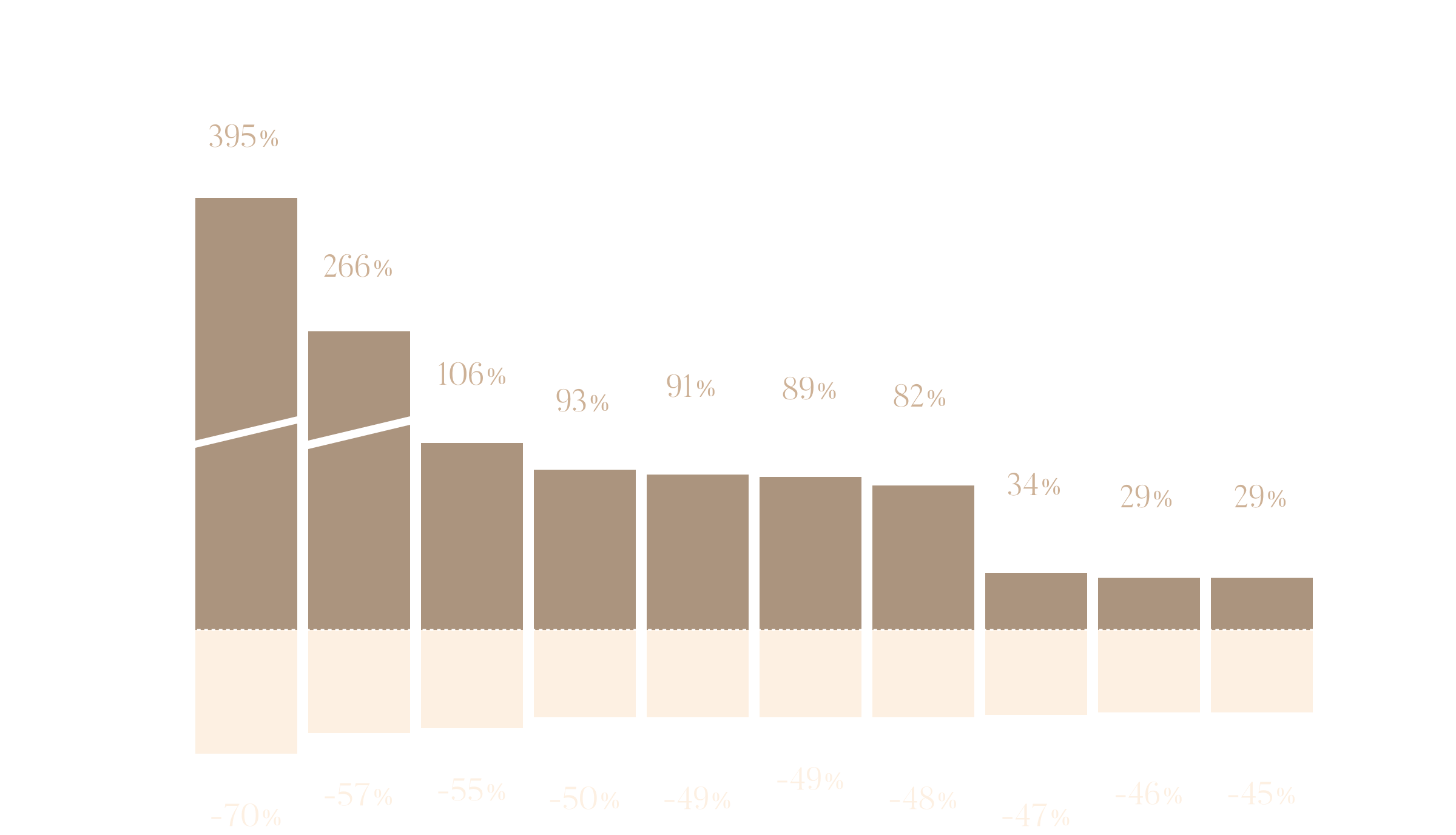

CEO mentions of Tariffs in Q2 climbed 395% quarter-over-quarter, following a similarly dramatic 537% spike in Q1. Mentions of related trade topics like Trade War—last quarter’s top trending topic among CEOs—and Supply Chain Shifts also increased sharply. The switch in rank of the two most-discussed trade topics—Tariffs and Trade War—suggests that CEOs have moved from anticipating a trade war to navigating its impact: tariffs.

Other trending topics, like Trade Flows—which appears on the Radar’s trending list for the first time—suggest that CEOs aren’t just reacting to new policy; many are rethinking sourcing, production and pricing strategies.

But the talk of Tariffs comes with a deeper sense of economic caution.

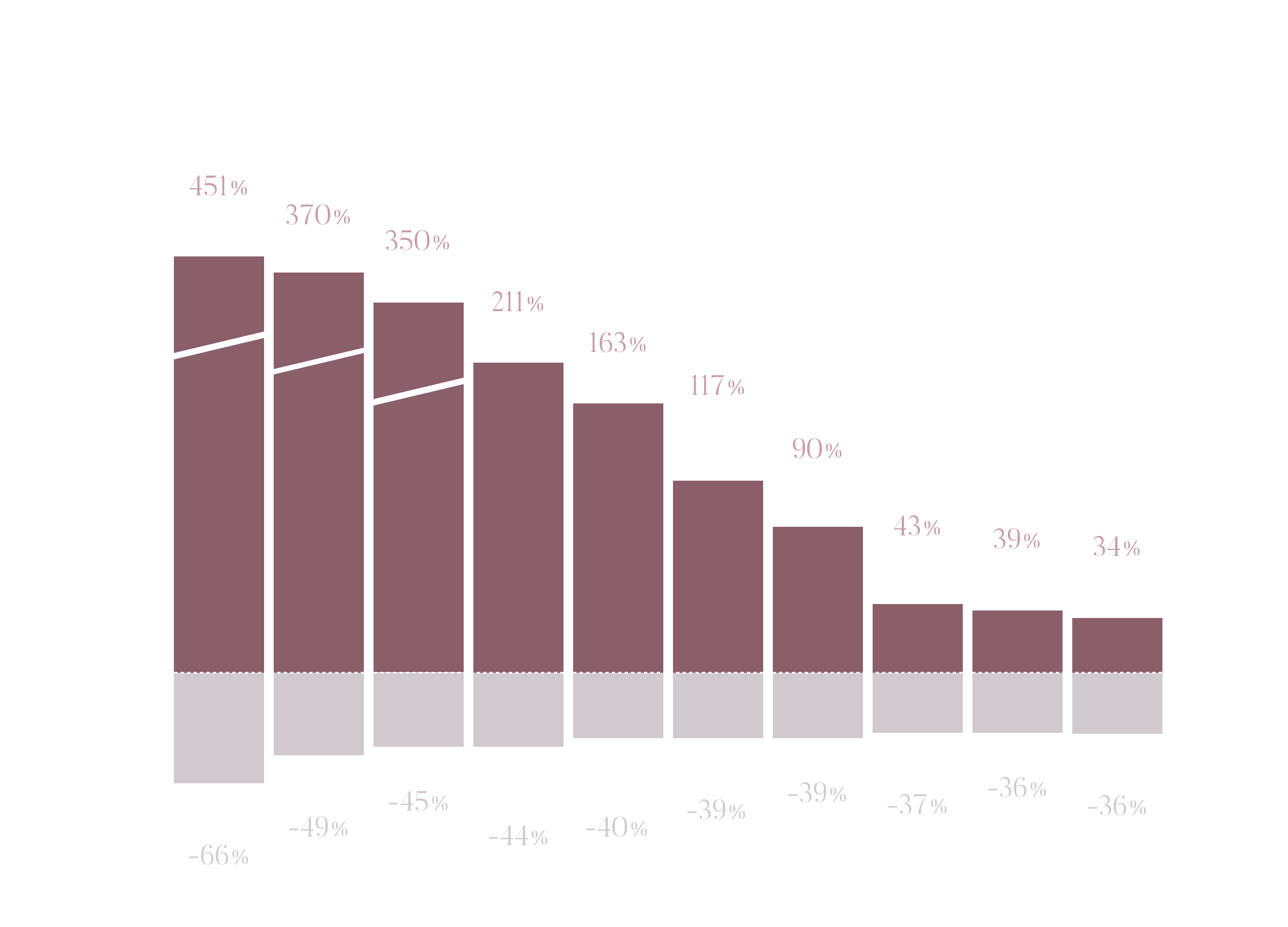

For analysts, concern of a downturn is well underway. Mentions of Economic Slowdown skyrocketed 451%, suggesting that analysts are aggressively probing for signs of weakness. Concurrent rises in mentions of Oil Prices, Consumer Confidence and Consumer Spending point to the specific dimensions of that concern, suggesting a growing anxiety about price volatility and softening demand, both of which may signal or contribute to a slowdown.

While CEO mentions of Economic Slowdown grew less substantially, the 91% increase nevertheless shows a significant shift. Corporate executives are judicious when it comes to publicly discussing slowdown fears, cognizant of shaking investor confidence. In Q2, the concern was prevalent enough to demand their acknowledgment.

As Washington announced reciprocal tariffs on April 2, then suspended them for 90 days while trade talks progressed, CEOs and other senior executives were left to put a brave face on developments, promising they could survive no matter how high the levies ultimately are set:

Conversely, environmental and sustainability-related topics were among the biggest decliners for CEOs and analysts alike in Q2. The trend is a continuation of the deprioritization of climate issues found by the Radar over the previous two quarters; it also reflects a larger pattern of steps taken by business leaders in response to the policy direction of the new administration in the US. In June, Bloomberg Businessweek reported that major corporations are abandoning their climate pledges at an increasing rate.

Tariffs are now the top-mentioned topic globally among both CEOs and analysts—the first time the CEO Radar has found an alignment on the most-discussed topics between both groups.

The alignment of agendas between CEOs and analysts in Q2 is uncharacteristically close. For the first time this year, eight of the top 10 most-mentioned topics appear on both lists, suggesting that the strategic and financial sides of the market are zeroing in on the same risks.

Still, the gaps are telling. Analysts continue to focus more on external risk and exposure, pressing CEOs on topics like Competition and China. CEOs, on the other hand, are still trying to manage factors that are more controllable internally, such as Partnerships and New Products.

AI & Machine Learning remained on both top 10 lists, but slipped one position to #10 for analysts. The drop-off comes as economic headwinds are pushing leaders to prioritize more immediate pressures. However, BCG warns that minimizing AI could be shortsighted.

By combining Tariffs with seven other topics related to trade and taxes, we’re able to more clearly see regional differences when it comes to the quarter’s top issue.

Together, these eight distinct but related topics saw a sharp and unified rise in mentions by both CEOs and analysts in Q2. For the topics most directly connected to trade, numbers soared by triple digits. On the other hand, mentions of Tax Policy and Tax Rate remained flat or even declined slightly—a contrast that signals that the trade conversation is centered around more volatile and uncontrollable factors, like tariff policy.

Regionally, discussions of Trade & Taxes rose everywhere, but nowhere more than in Asia. Asia is where tariffs are likely to have their biggest effect, according to the Bloomberg US Tariff-Impact Matrix, a tool that helps identify companies’ exposure to US tariffs. As of late June, it found that Asia-based companies will face the highest median tariff rate (15%), which will cut their profits by 9.6%—impacting these companies more than tariff impacts in any other region.

Yet even as they face mounting pressure, many Asian business leaders are pursuing a dual strategy.

Europe’s more modest gains in mentions of Trade & Taxes may suggest a less acute perception of trade-related risks or impacts, or possibly more attention diverted to other topics.

The intense focus on trade in Q2 wasn’t just a shift in focus, but also a narrowing. Out of nearly 300 topics tracked, CEO discussion declined for 229 of them in Q2, compared to just 69 in Q1 and 173 in Q4 2024. Even cost-related topics—often discussed on earnings calls—fell across the board. One cost-related topic bucked the trend: Material Costs saw a rise in mentions in every region, a sign that CEOs remain concerned about inputs that are critical to business.

The takeaway from Q2’s earnings calls is that executives are hungry for direction. The rise in language surrounding trade, uncertainty and economic downturn, from both CEOs and analysts, shows that it’s anyone’s guess where near-term corporate performance and economic indicators are headed. While many CEOs project confidence by necessity, many more sound like they’re holding their breath.

To assess CEO agendas globally, we examined the Q2 2025 earnings calls of the 10,182 companies in the Bloomberg World Large, Mid & Small Cap Total Return Index (WLST). The index covers 99% of the market cap of the measured market.

The total number of earnings calls we analyzed was smaller than 10,182 because not all jurisdictions require publicly listed companies to report their earnings on a quarterly basis. Also, the Bloomberg database of earnings call transcripts includes only companies that conduct earnings calls in English, as well as some large Japanese companies for which we translate the calls into English.

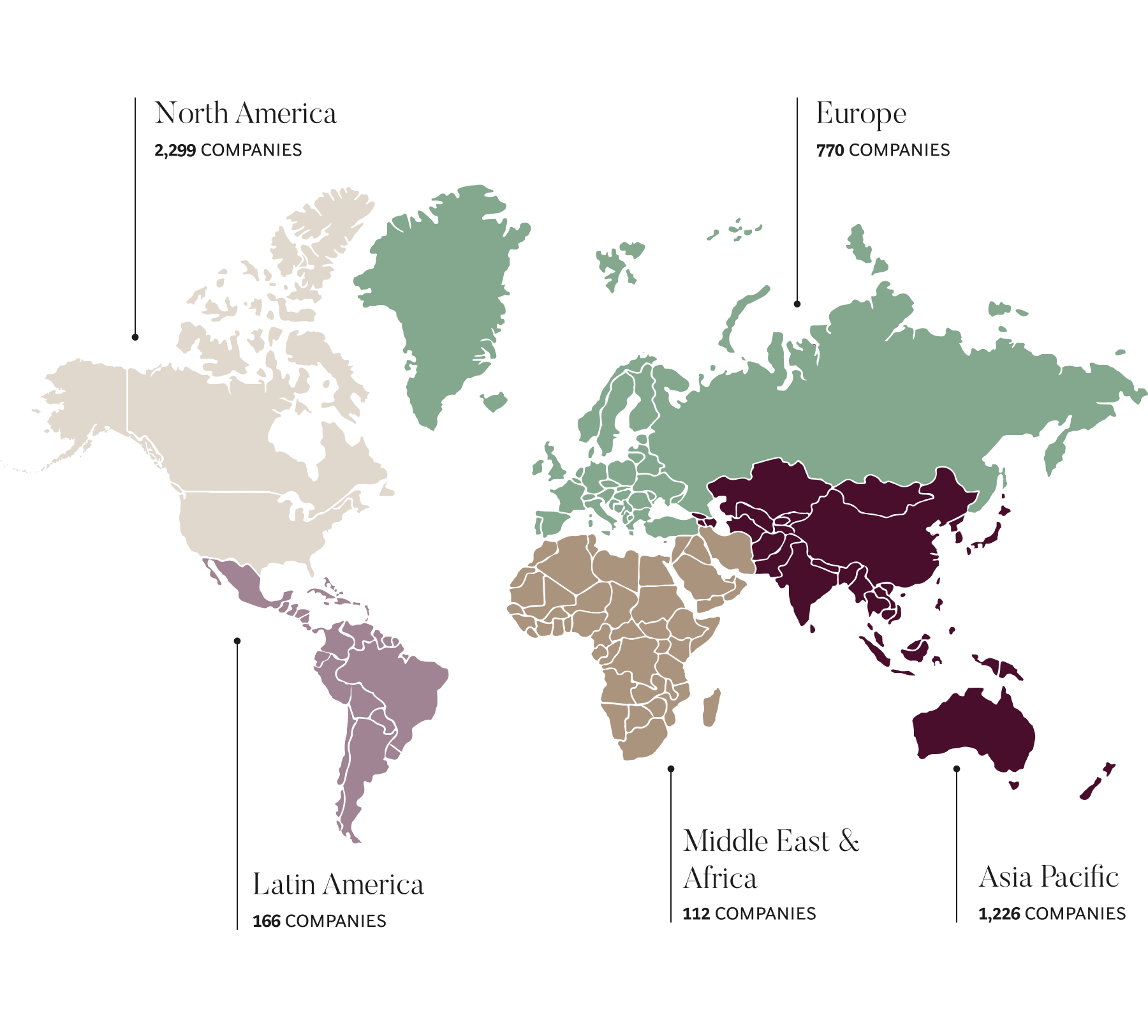

In Q2 2025, there were 4,573 WLST earnings calls in the Bloomberg database—within the historical range of 4,500 to 5,000 companies per quarter. The data covers calls conducted in Q2 through June 27. Here is the regional breakdown, based on where those companies are domiciled:

Bloomberg distinguishes between prepared remarks by CEOs and other C-suite members, and the questions asked by analysts. Within these categories of remarks, Bloomberg applies artificial intelligence to identify mentions of almost 300 topics.

By understanding when CEOs are discussing a given topic—even if they don’t use a set of specific keywords—the Radar creates trend analytics that allow CEOs to spot emerging themes and shifts in corporate agendas, without the “noise” inherent in a system that simply searches for any mentions of keywords.

Topics can be mentioned multiple times in a given earnings call transcript. They are counted multiple times if mentioned in separate paragraphs, but counted only once if they are mentioned multiple times in a single paragraph.

To be included as a CEO or analyst trending topic in this report, a topic had to be mentioned at least 50 times in either Q1 or Q2 2025. To be included in our regional breakouts, topics had to be mentioned at least 25 times in a given region in either Q1 or Q2.

For the lists of most-mentioned topics, we excluded topics that refer to a company’s financial metrics or corporate actions, such as Revenue or Buybacks, because they are among the most-mentioned topics every quarter. We also excluded topics related to commodities because they are of interest to a relatively small number of companies.