The CEO Radar Q2 2025

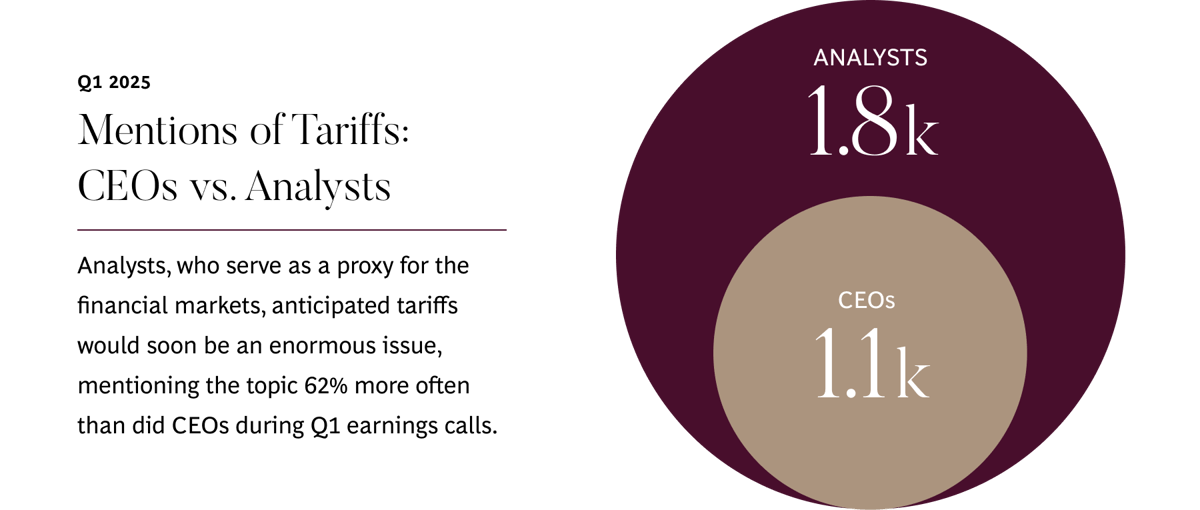

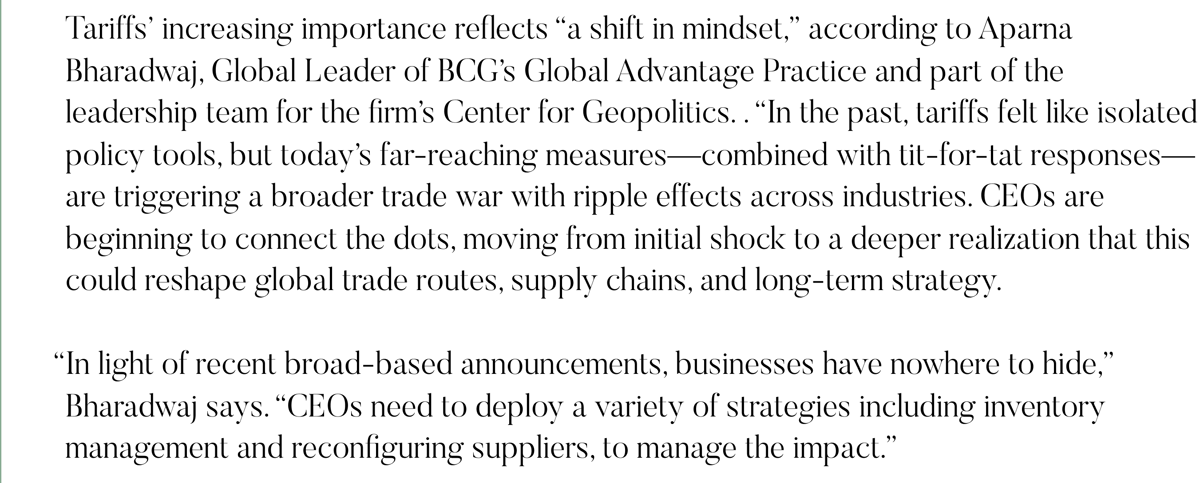

Financial analysts were far more prepared than most CEOs for the US tariffs announced on April 2, the second edition of the CEO Radar has found.

The gap signals that businesses are scrambling to respond to tariffs that promise to reshape global trade routes, supply chains, and long-term growth strategies.

Other key findings of the Radar include:

The CEO Radar is a tool to help CEOs determine which issues truly deserve their time and attention. It unpacks the leading topics discussed on earnings calls, enabling chief executives to compare their agendas to those of their peers, and to the financial markets’ expectations.

Using artificial intelligence, BCG and Bloomberg Media Studios analyzed what CEOs and analysts were saying about roughly 300 topics across 4,864 earnings calls worldwide in Q1 2025. The Radar tracks which topics are trending higher or lower, and the issues on which CEOs are leading or lagging the financial markets.

CEO mentions of Trade Wars increased 950% worldwide in Q1 2025. Tariffs, Supply Chain Shifts, Tax Policy and Operational Risk Management all made the top-10 trending list as well.

CEO mentions of Election Risk—which reached a two-decade high in Q4—led the list of Q1 decliners.

Overall, analysts and CEOs were more aligned in their interests in Q1 compared to Q4. One of the biggest topic gainers for CEOs—Tariffs—and four of the biggest decliners—Election Risk, Strikes, Oil Prices and Natural Disasters—also made the top-10 lists of analysts.

The top five most-mentioned topics on the CEO list also appear on the analyst list.

AI & Machine Learning crept up from sixth place in Q4 to fourth in Q1 on the CEO list, and from 14th to ninth place on the analyst list.

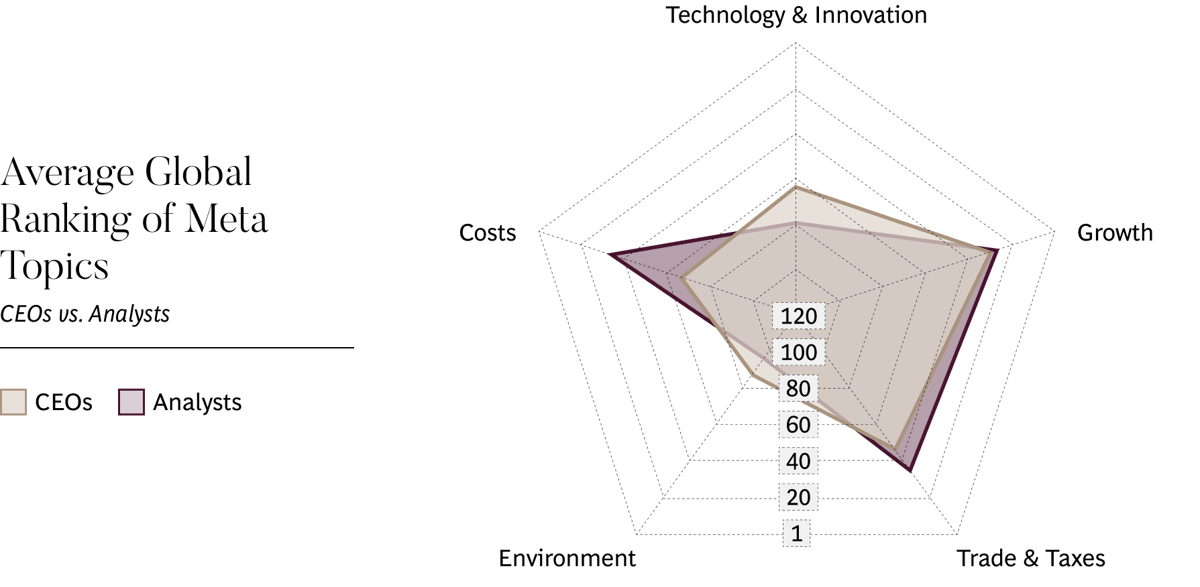

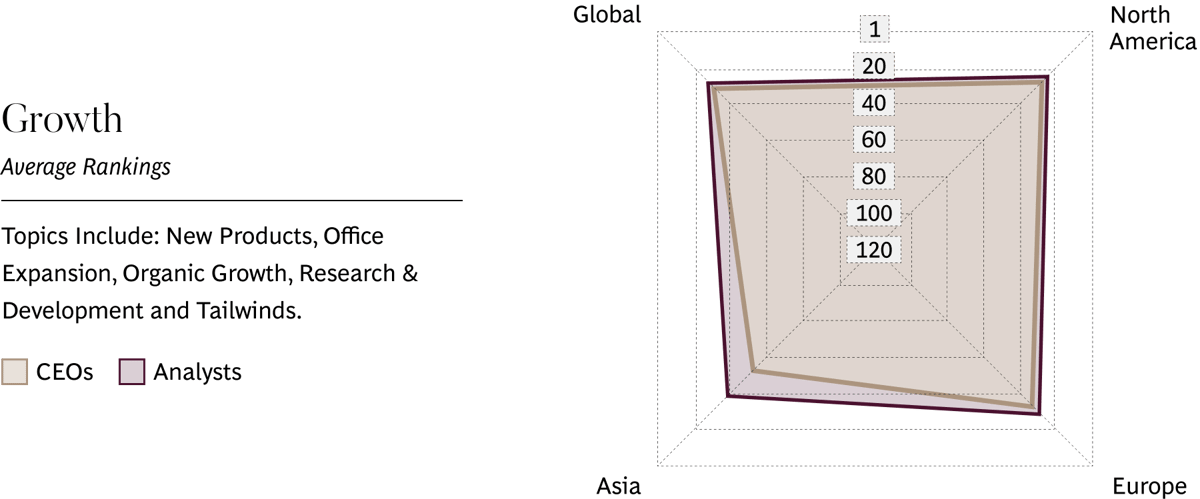

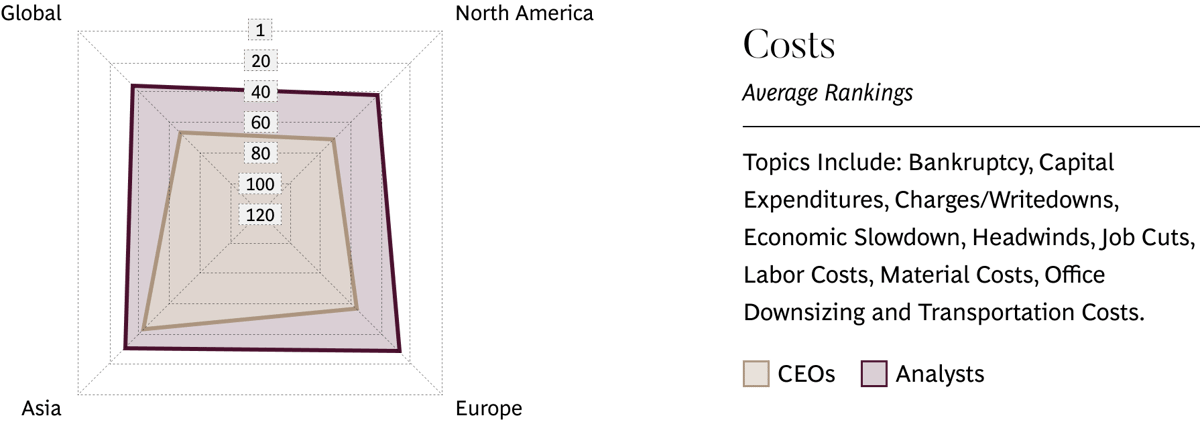

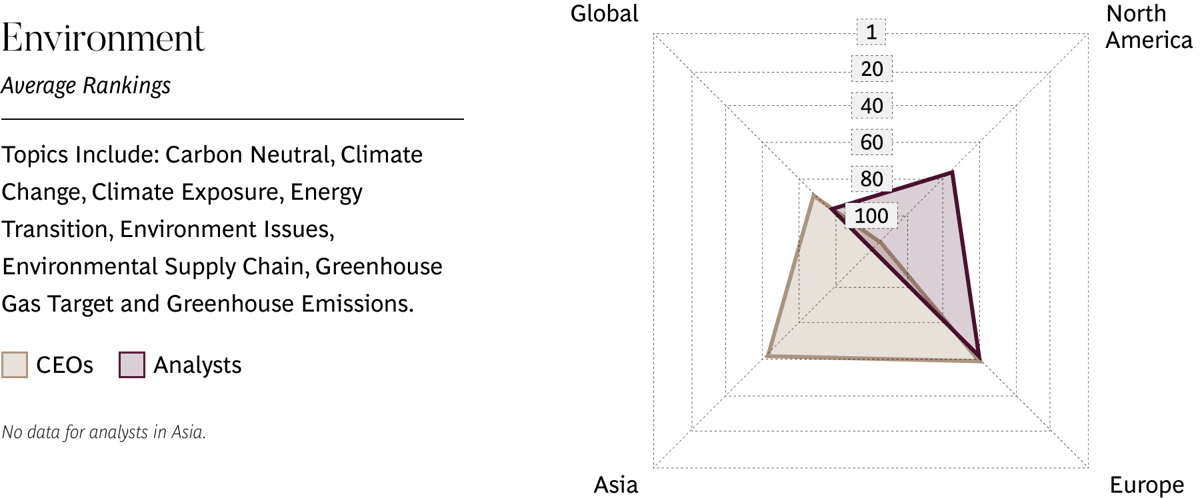

To track broader trends, we averaged the rankings of five to 10 related topic areas, and calculated where each meta topic ranks in the level of importance CEOs and financial market analysts assigned to these areas in Q1 2025. The averages are calculated globally and by region. The lower the number, the higher the level of importance on the agenda.

At the global level, CEOs and analysts are most at odds over the importance of Costs—analysts ranked the meta topic 34th in Q1, compared to 66th for CEOs—and Technology & Innovation, which CEOs ranked 16 places higher than analysts.

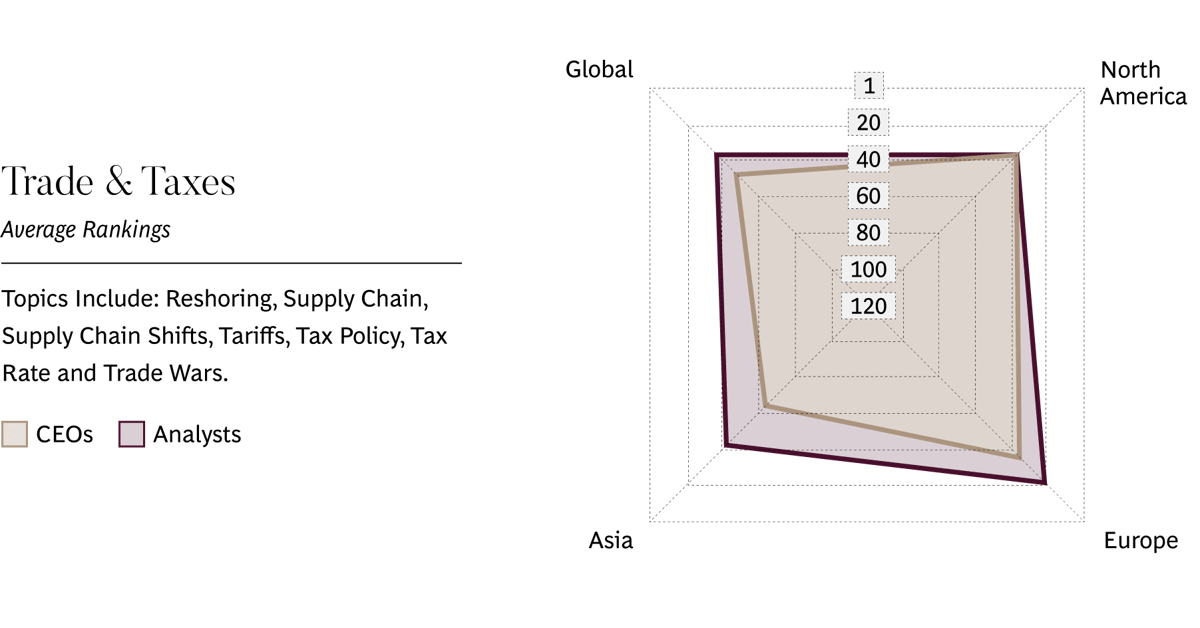

Topics comprising the Trade & Taxes category rose in Q1 to an average ranking of 46 among the most-mentioned topics for CEOs, up from 64 in Q4 2024. Only Asian CEOs were outliers, with the topics scoring an average rank of 63 in that region.

Within Trade & Taxes, mentions of Tariffs by global CEOs rose 537% in Q1. But the degree to which they addressed this topic is clearly rooted in geography: Mentions in North America were up 1,080%, compared to 470% for Europe and 86% for Asia.

Globally, there was a 325% rise in Tariffs mentions by analysts, but here too, there were regional differences. North American analysts mentioned Tariffs 399% more in Q1 than in Q4, while mentions by European and Asian analysts rose 281% and 220%, respectively—unmistakable, surround-sound signals of the priorities of the financial markets.

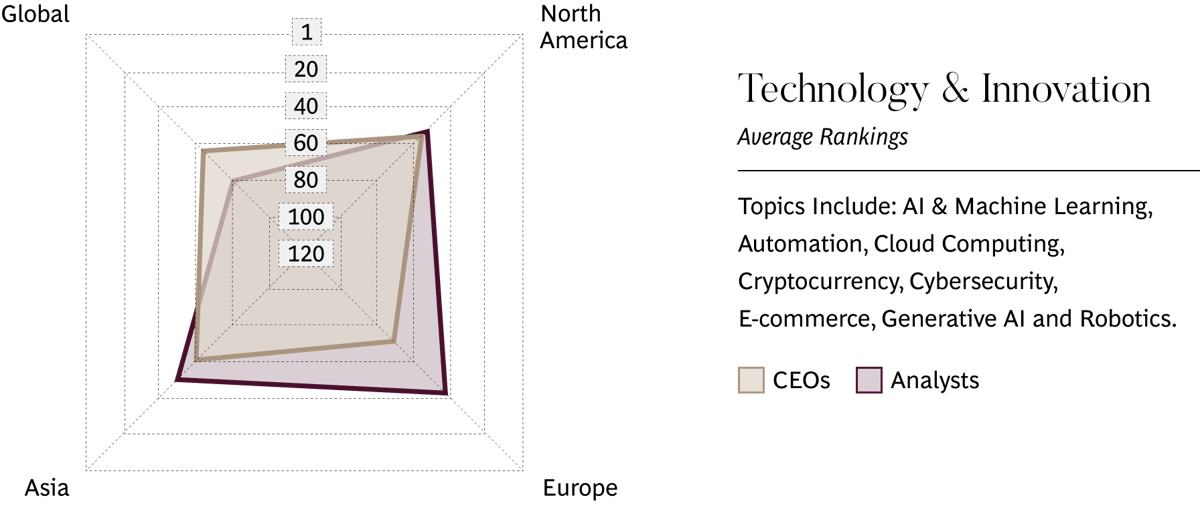

European CEOs are talking more about Technology & Innovation topics, though they still trail their counterparts in North America and Asia in the importance they place on these topics.

Although Technology & Innovation achieved an average ranking of only 70 on European CEO agendas, Q1 mentions of the group’s subtopics surged: Automation climbed 171%, AI & Machine Learning increased 146%, Generative AI rose 109% and Robotics climbed 90%.

Technology & Innovation topics mattered even more to European analysts than the continent’s CEOs, with an overall average agenda ranking of 41. The standout subtopic was AI & Machine Learning, with mentions by analysts rising 110% in Q1. It’s worth noting that Europe was the only region that saw a significant variance between tech mentions by CEOs and analysts.

In Asia, Cryptocurrency emerged as a hot topic, with CEOs raising it 117% more often in Q1 than Q4—the largest increase for any topic in Asia. It ranked 78 on the Asia CEO list of topics—comparable to North America, where it ranked 65. By contrast, Cryptocurrency is almost absent from earnings discussions in Europe.

Worldwide, CEOs and analysts discussed Growth topics at about the same rate, after mentions by CEOs climbed from 74th place in Q4 to 30th in Q1.

Asian CEOs gave less attention to Growth topics in Q1, with far less discussion of Organic Growth or Tailwinds than in other regions. That wasn’t the case with Asian analysts: Growth ranked 38 on their agenda, compared to 52 for Asian CEOs. Many Asian countries are wrestling with significant unemployment, and growth throughout the region could feel the ill effects of trade wars.

Europe, meanwhile, was the only region that saw increased attention paid to R&D. Mentions were up 45% for European CEOs, compared to declines of 9% and 8% for North American and Asian CEOs, respectively.

Among North American CEOs, talk of Headwinds outpaced the benefits of Tailwinds: Headwinds mentions were up 24% quarter over quarter, while Tailwinds mentions declined 16%. European CEOs were more optimistic, with mentions of Tailwinds up 85% and Headwinds increasing a more modest 42%. Mentions of each were down in Asia—Tailwinds by 14% and Headwinds by 4%.

CEOs globally were talking far less in Q1 about Costs than Growth. The financial markets, however, were talking about both meta topics about equally. Among analysts globally, Costs topics rose from 74th place in Q4 to 34th in Q1—far ahead of the 66th rank in Q1 among global CEOs.

The same dichotomy played out in all three regions: Costs ranked 12 places higher for Asian analysts than for the region’s CEOs; 28 places higher for European analysts; and 30 places higher for North American analysts.

In the regions, Asian CEOs discussed cost issues more than growth topics, while it was the reverse among CEOs in North American and Europe.

In Asia—generally the beginning of global supply chains—discussion of both Labor and Transportation Costs was about twice as common among the region’s CEOs compared to Europe’s CEOs. Mentions of Capital Expenditures ranked about equally in all three regions, but that’s after a 69% increase in Q1 mentions by European CEOs.

In Europe and Asia, analysts asked about Charges and Writedowns about twice as often as they did in North America.

The rush away from environmental topics is very much a geographic phenomenon. The trend is strongest among CEOs in North America, where the new administration in Washington has made the government’s pivot away from climate issues a priority.

But in Europe and Asia, CEOs continued to talk about environmental issues in Q1. In fact, in Europe, mentions of topics including Climate Change, Climate Exposure and Greenhouse Gas Emissions each rose by more than 100% quarter over quarter. The topics matter to European analysts as well, while Asian analysts are sitting on the sidelines, mentioning environmental issues so infrequently that they don’t even chart.

To assess CEO agendas globally, we examined the Q1 2025 earnings calls of the 10,182 companies in the Bloomberg World Large, Mid & Small Cap Total Return Index (WLST). The index covers 99% of the market cap of the measured market.

The total number of earnings calls we analyzed was smaller than 10,182 because not all jurisdictions require publicly listed companies to report their earnings on a quarterly basis. Also, the Bloomberg database of earnings call transcripts includes only companies that conduct earnings calls in English, as well as some large Japanese companies for which we translate the calls into English.

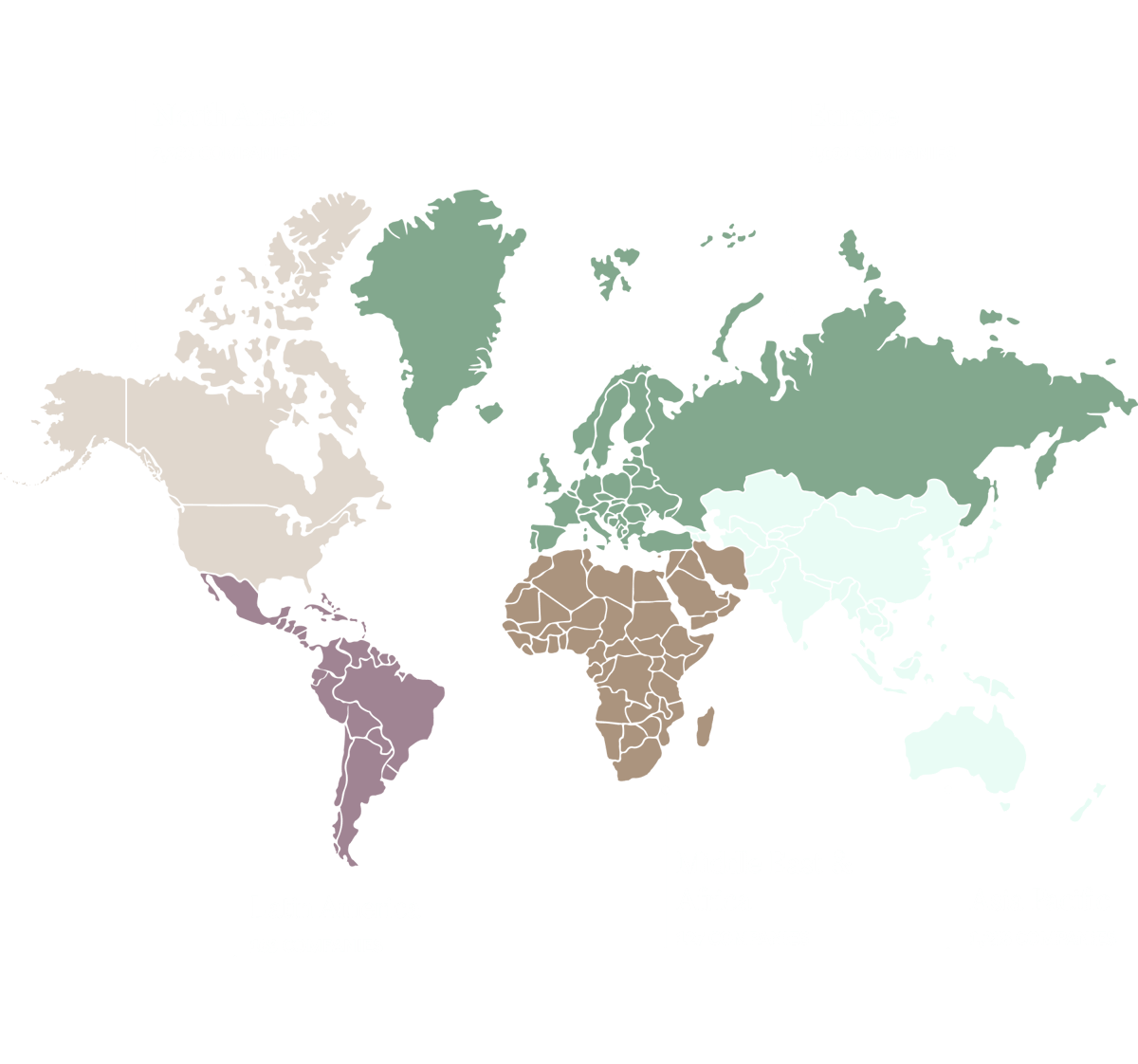

In Q1 2025, there were 4,864 WLST earnings calls in the Bloomberg database—within the historical range of 4,500 to 5,000 companies per quarter. The data covers calls conducted in Q1 through March 28. Here is the regional breakdown, based on where those companies are domiciled:

Bloomberg distinguishes between prepared remarks by CEOs and other C-suite members, and the questions asked by analysts. Within these categories of remarks, Bloomberg applies artificial intelligence to identify mentions of almost 300 topics.

By understanding when CEOs are discussing a given topic—even if they don’t use a set of specific keywords—the Radar creates trend analytics that allow CEOs to spot emerging themes and shifts in corporate agendas, without the “noise” inherent in a system that simply searches for any mentions of keywords.

Topics can be mentioned multiple times in a given earnings call transcript. They are counted multiple times if mentioned in separate paragraphs, but counted only once if they are mentioned multiple times in a single paragraph.

To be included as a CEO or analyst trending topic in this report, a topic had to be mentioned at least 50 times in either Q4 2024 or Q1 2025. To be included in our regional breakouts, topics had to be mentioned at least 25 times in a given region in either Q4 or Q1.

For the lists of most-mentioned topics, we excluded topics that refer to a company’s financial metrics or corporate actions, such as Revenue or Buybacks, because they are among the most-mentioned topics every quarter. We also excluded topics related to commodities because they are of interest to a relatively small number of companies. Once those adjustments were made, we were left with a list of 205 topics discussed on Q4 earnings calls.