The CEO Radar Q4 2025

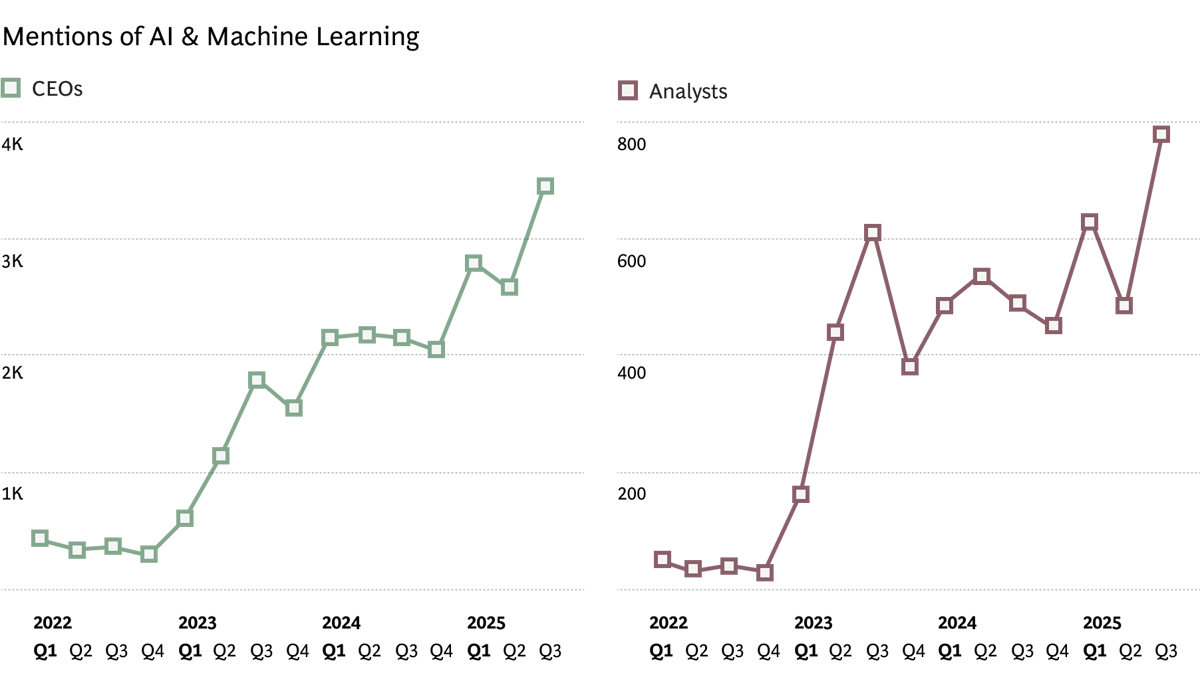

After months of tariff turmoil and recession fears dominating agendas from C-suites to Wall Street, CEOs are shifting from a defensive posture to an offensive one. While the lion’s share of earnings call topics still revolve around tariffs and macro risks, the intensity of those conversations is ebbing as companies learn to live with trade uncertainty. In a sign of a renewed focus on growth, CEOs are talking more about long-term performance drivers that they have greater control over—with AI mentions hitting an all-time high.

These are the key findings of the fourth edition of the CEO Radar, an AI-powered analysis from BCG and Bloomberg Media Studios of more than 4,811 quarterly earnings calls worldwide.

AI & Machine Learning continued to occupy a prominent space in boardroom discussions, but the notable shift on earnings calls came from Wall Street. For the first time, AI entered the top 10 trending topics for analysts, with mentions up 55% quarter-over-quarter. CEOs, meanwhile, continued to place heavy emphasis on AI, with the topic maintaining its hold on their top five most-mentioned themes globally.

CEOs discussed AI largely in the context of innovation and growth, and as a response to external pressures beyond their control. As trade uncertainty weighs on margins, executives are emphasizing AI as a tool to manage supply chains and boost efficiency, productivity and resilience.

“Leading companies are using AI not only to master an increasingly uncertain business landscape, but also to reshape and reinvent how their businesses work,” says Nicolas De Bellefonds, a Managing Director and Senior Partner at BCG who leads the company’s AI and generative AI efforts globally. “AI-driven scenario planning, for example, is helping them optimize supply chains for greater resilience, manage pricing decisions, and gain greater clarity to make bold investments that drive future growth. But this is an elite group: Only 5% of companies we’ve studied are ‘AI-Future Built,’ meaning they are already realizing significant value from their AI investments.”

The consequence, says De Bellefonds, is the widening “AI value gap” wherein early movers are building stronger technology stacks, while laggards are trapped in a cycle of stalled pilots and mounting investor skepticism. With analysts discussing not only AI & Machine Learning but also Robotics, Driverless Vehicles and Automation this quarter, the market is keen to see AI executions deliver ROI.

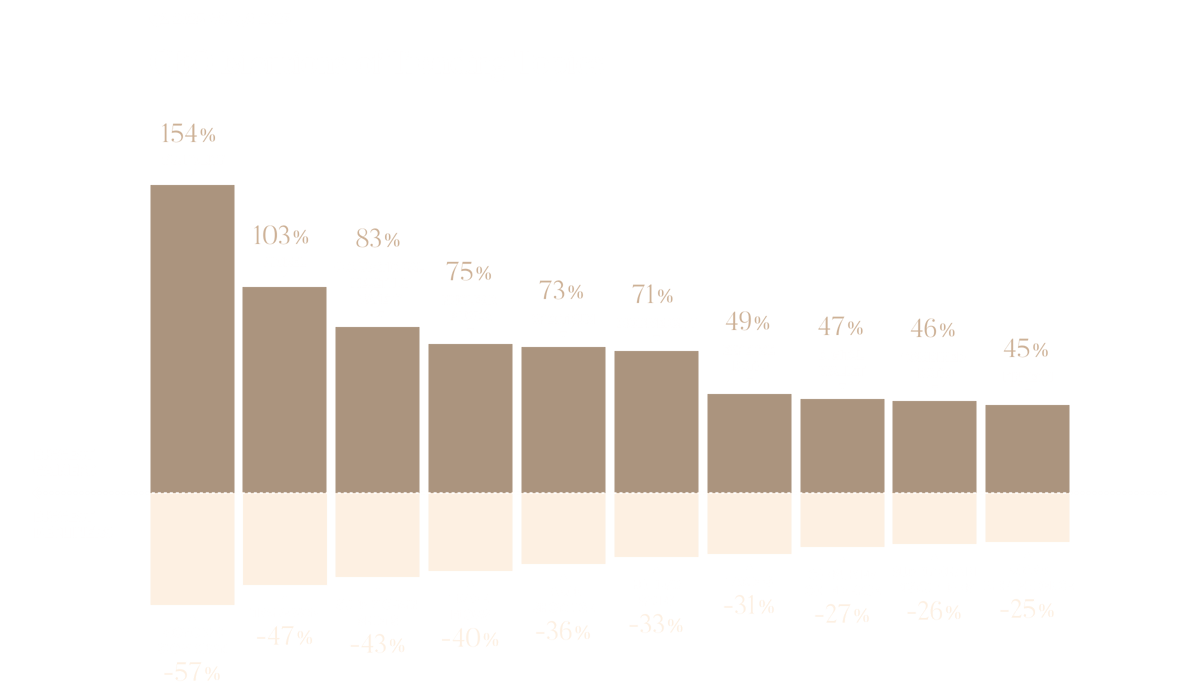

This quarter’s biggest gainers reflect a pivot from considering the shock of externalities to strategically managing them. Tax Policy rose 154% globally on CEO agendas—partly a reaction to major legislation including the United States’ One Big Beautiful Bill Act, signed into law on July 4, and a signal that companies are looking closely at how fiscal policy will shape investment and cash flow strategies.

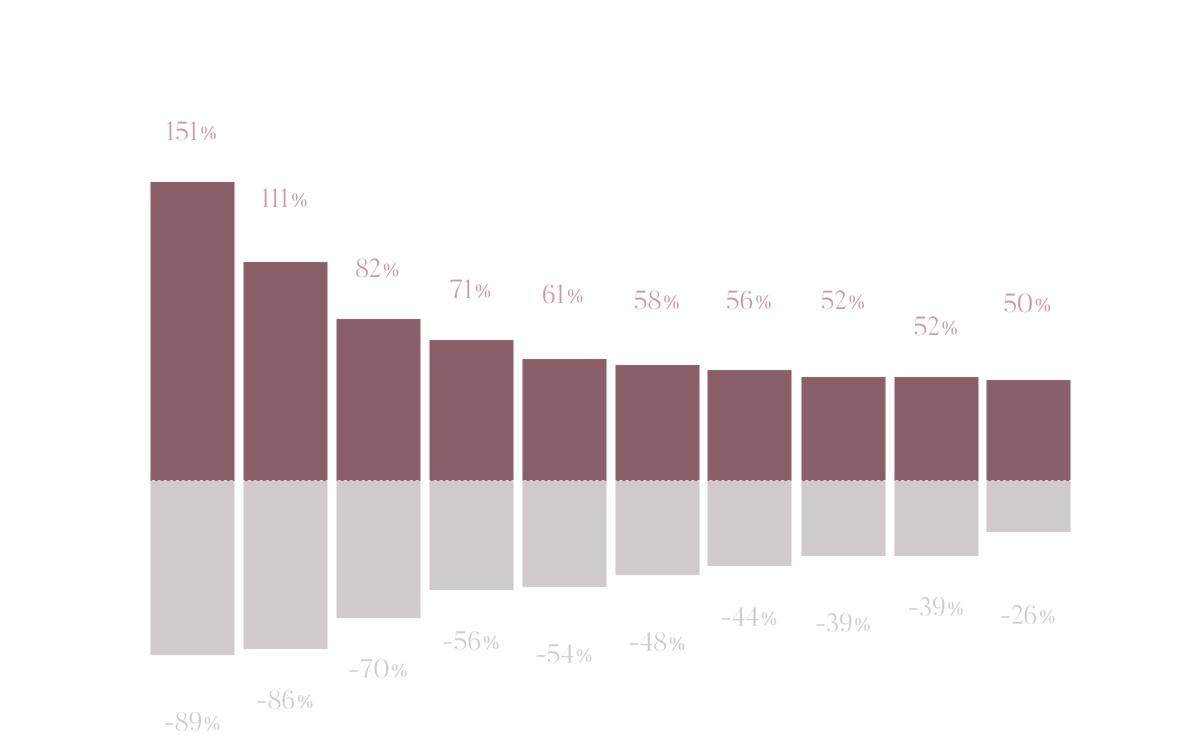

Critical product inputs are another standout. Nickel (+103% for CEOs) and Copper (+82% for analysts) highlight how supply chain inputs—which executives can act on directly—are moving back into the spotlight. On the analyst side, the top gainers, Cryptocurrency (+151%) and M&A Strategy (+111%), suggest that the market is probing for new sources of growth. Substantial increases in discussions of AI & Machine Learning, Robotics, Driverless Vehicles and Automation further suggest that the market has its eye fixed on innovation.

The decliners tell an equally important story. Mentions of Economic Slowdown fell 57% among CEOs and 89% among analysts. This sharp reversal suggests that while fears of a downturn are still prevalent in terms of total mentions, they are no longer the dominant lens through which performance is viewed. Likewise, topics like Trade War and Supply Chain Shifts are retreating after months of rising concern.

A picture of transition emerges: Companies are managing long-term tariff-induced volatility by refocusing on competitiveness and growth.

While trending topics highlight change, the most-mentioned topics reflect relative continuity for both CEOs and analysts, and show that CEOs are still anchoring their messaging in fundamentals.

Despite gains for AI and Tax Policy, the most-mentioned topics globally remain familiar: Tariffs, Leverage, Competition and Headwinds. These are the issues that business leaders must acknowledge in every earnings call.

The middle-ranked topics on the most-mentioned lists reinforce this quarter’s main takeaways. AI & Machine Learning, New Products and Partnerships are now firmly entrenched among the topics most discussed by CEOs and analysts, showing how strategy conversations are diversifying again after two quarters dominated by trade.

To track broader trends around the world, we roll individual topics into broader categories we call Meta Topics. This quarter’s Meta Topics underscore the notion that companies are learning to live with trade uncertainty. Globally, mentions of Tariff Policy—which includes Tariffs, Tax Policy, Tax Rate, Trade Flows and Trade War—dropped 20% among CEOs and 41% among Analysts. At the same time, discussions of growth-oriented levers all climbed at double-digit rates.

Beneath the global topline numbers, some divergences emerge across geographies. In North America, the epicenter of rapidly shifting trade policies, CEOs mentioned Tariff Policy 32% less, the biggest decline among regions. After months of defensive positioning, US company leaders appear to be moving on from Washington’s unpredictability. Analysts, on the other hand, are pressing hard on innovation. Mentions of Tech & Innovation jumped 37%, signaling investor impatience for AI and automation deployments to start showing measurable ROI.

By contrast, European CEOs are still highly attuned to economic disruption. Mentions of Tariff Responses rose 27%, while Uncertainty spiked 69%, reflecting a continued emphasis on volatility. Yet, the region is still attuned to growth. Mentions of AI-related topics surged significantly among both CEOs and analysts, reflecting Europe’s urgency to close the competition gap with North America and Asia.

Numbers were more muted in Asia, with declines across the board among CEOs, suggesting the absence of a dominant discussion driver. On the analyst side, attention coalesced around Generative AI and Robotics, supporting the indisputable finding of this quarter’s report: The world has fixed its gimlet eye on AI.

To assess CEO agendas globally, we examined the Q3 2025 earnings calls of the 10,182 companies in the Bloomberg World Large, Mid & Small Cap Total Return Index (WLST). The index covers 99% of the market cap of the measured market

The total number of earnings calls we analyzed was smaller than 10,182 because not all jurisdictions require publicly listed companies to report their earnings on a quarterly basis. Also, the Bloomberg database of earnings call transcripts includes only companies that conduct earnings calls in English, as well as some large Japanese companies for which we translate the calls into English.

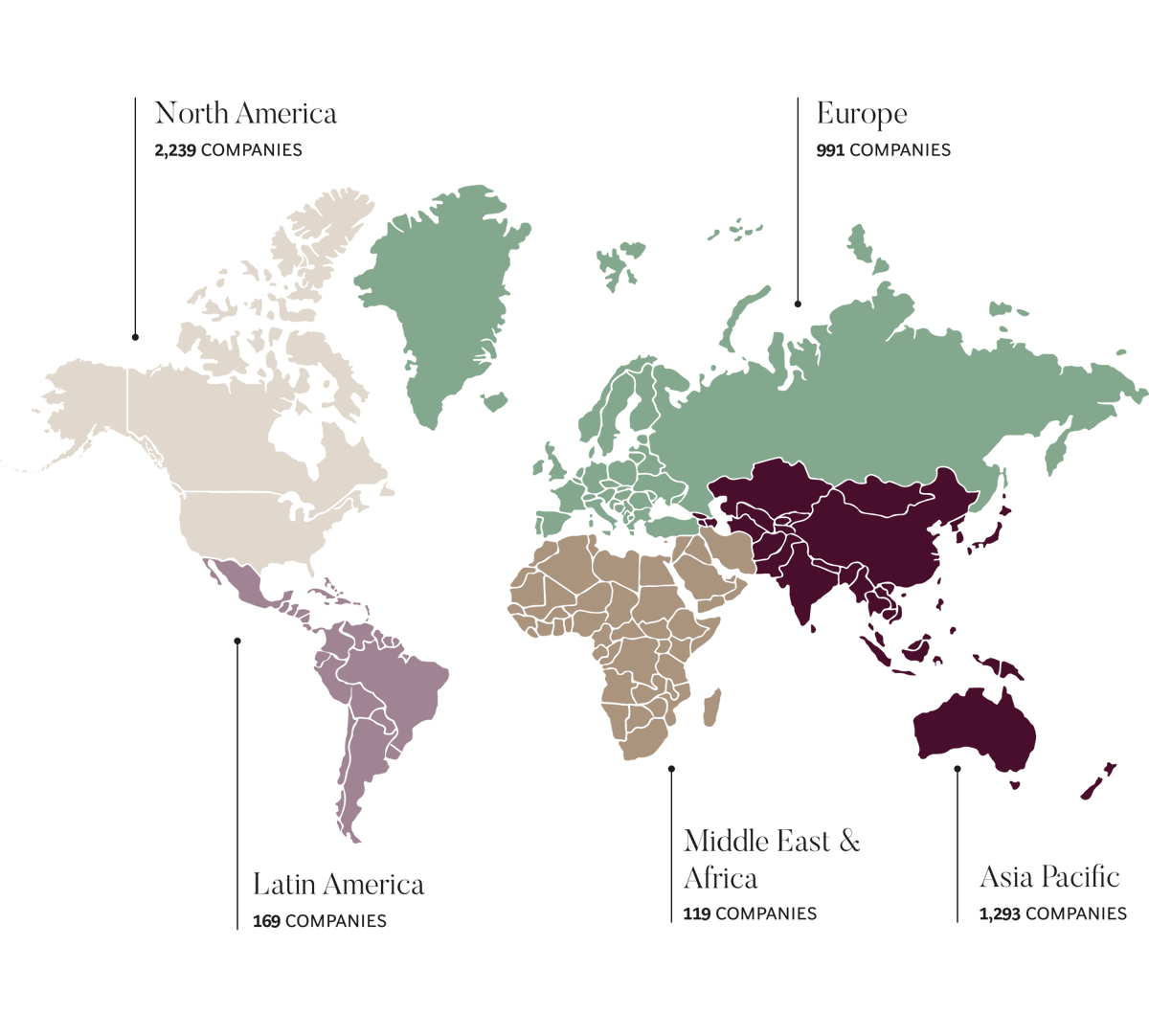

In Q3 2025, there were 4,811 WLST earnings calls in the Bloomberg database—within the historical range of 4,500 to 5,000 companies per quarter. The data covers calls conducted in Q3 through September 26. Here is the regional breakdown, based on where those companies are domiciled:

Bloomberg distinguishes between prepared remarks by CEOs and other C-suite members, and the questions asked by analysts. Within these categories of remarks, Bloomberg applies artificial intelligence to identify mentions of almost 300 topics.

By understanding when CEOs are discussing a given topic—even if they don’t use a set of specific keywords—the Radar creates trend analytics that allow CEOs to spot emerging themes and shifts in corporate agendas, without the “noise” inherent in a system that simply searches for any mentions of keywords.

Topics can be mentioned multiple times in a given earnings call transcript. They are counted multiple times if mentioned in separate paragraphs, but counted only once if they are mentioned multiple times in a single paragraph.

To be included as a CEO or analyst trending topic in this report, a topic had to be mentioned at least 50 times in either Q2 or Q3 2025. To be included in our regional breakouts, topics had to be mentioned at least 25 times in a given region in either Q2 or Q3.

For the lists of most-mentioned topics, we excluded topics that refer to a company’s financial metrics or corporate actions, such as Revenue or Buybacks, because they are among the most-mentioned topics every quarter. We also excluded topics related to commodities because they are of interest to a relatively small number of companies.