The CEO Radar Q1 2025

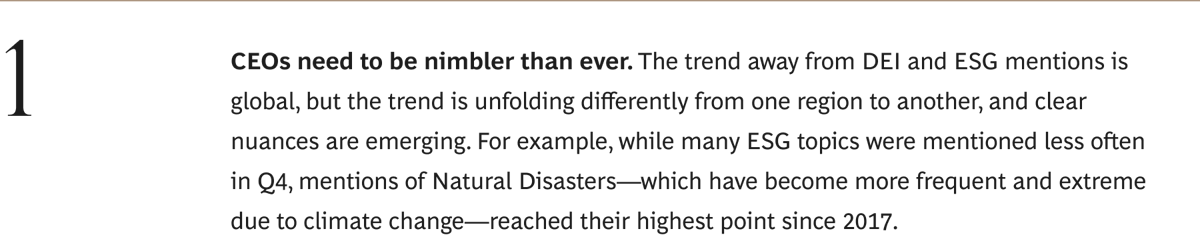

Natural Disaster

Mentions were higher than those in Q4 only twice in the last two decades. Although disasters occurred in every region in 2024, North American companies accounted for 80% of Q4’s mentions. Through November 1, the US experienced 24 weather events with losses exceeding $1 billion each—just behind 2023’s record of 28 such events, according to NOAA’s National Centers for Environmental Information.

Holiday Sales

Q4 saw the largest number of mentions of Holiday Sales since at least 2005.

Election Risk

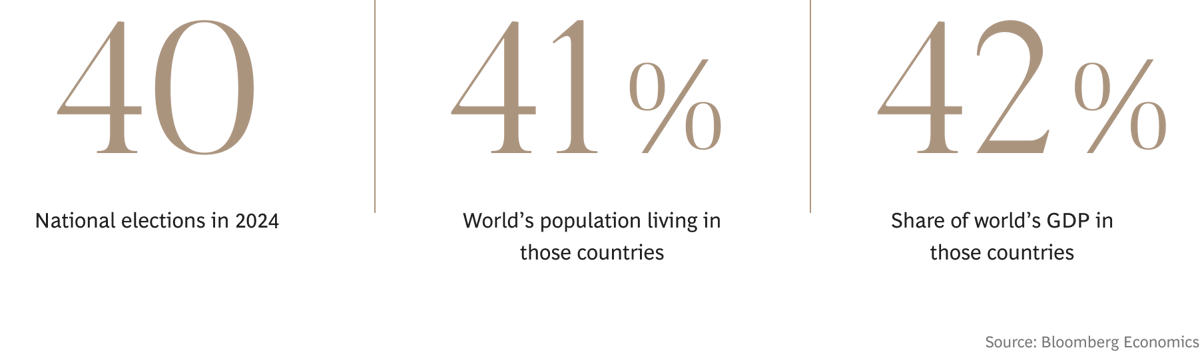

In connection with the 40 national elections held in 2024, CEOs discussed the topic of Election Risk at record levels—163% more often than they did during the last US presidential election.

Tax Policy

Mentions of Tax Policy trended upward, with about half of mentions coming from US CEOs.

Climate Exposure

Mentions dropped to levels not seen since 2020.

Community Rights & Relations, Board Independence and Diversity

Mentions of these DEI topics continued their years-long declines, reaching their lowest quarterly levels at any point during the Biden administration.

Consumer Price Index

After the US Federal Reserve cut interest rates in late Q3 and other central banks followed suit, mentions of inflation waned considerably.

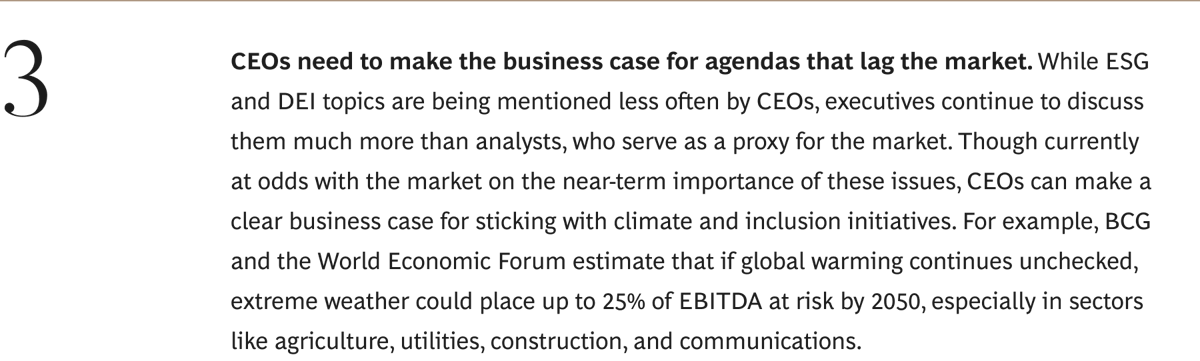

DEI

Mentions in Europe dropped along with those in the US, while mentions in Asia rose.

Climate

Mentions generally declined in Europe at an even faster pace than in the US, while mentions in Asia declined less or rose modestly.

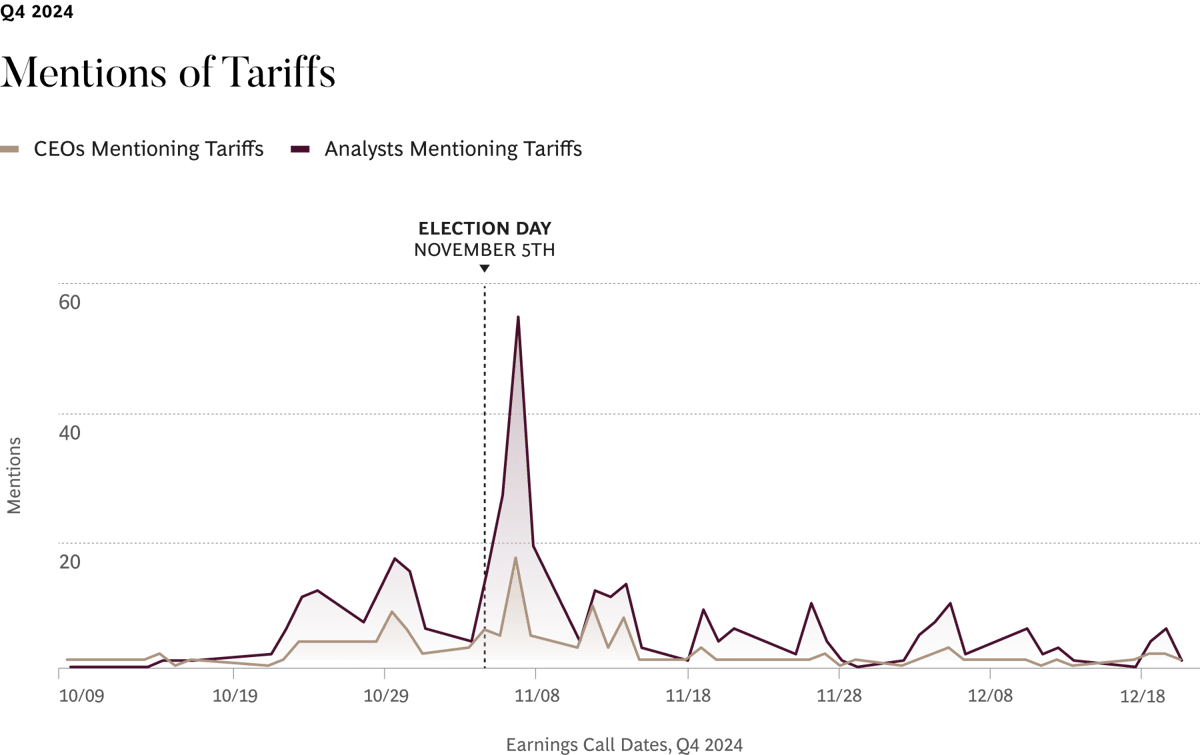

Trade

Mentions in the US and Asia generally moved up, while mentions in Europe declined considerably.

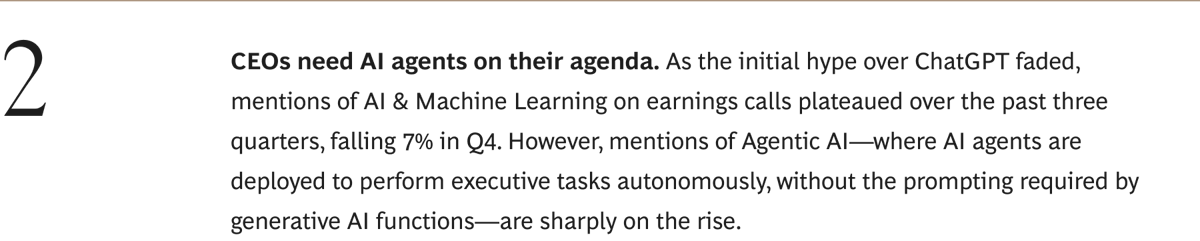

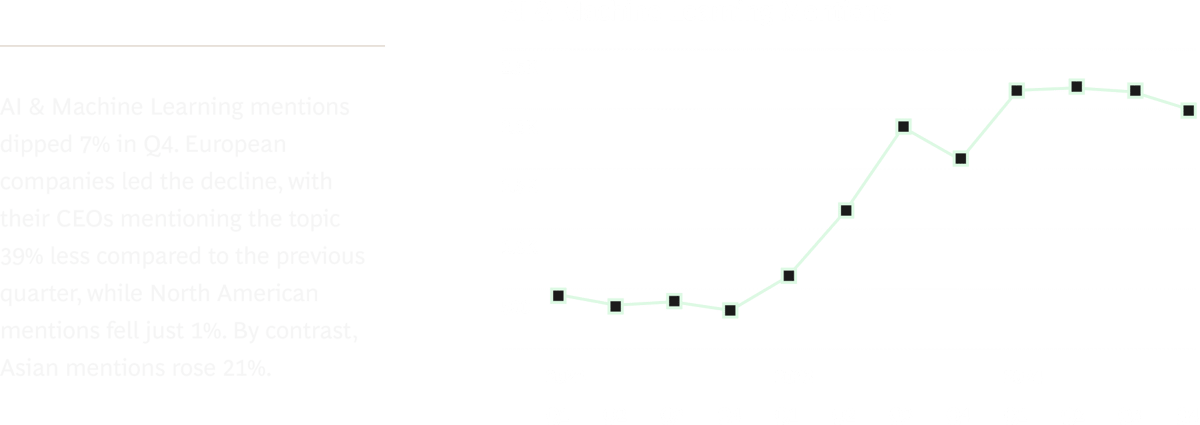

AI & Machine Learning

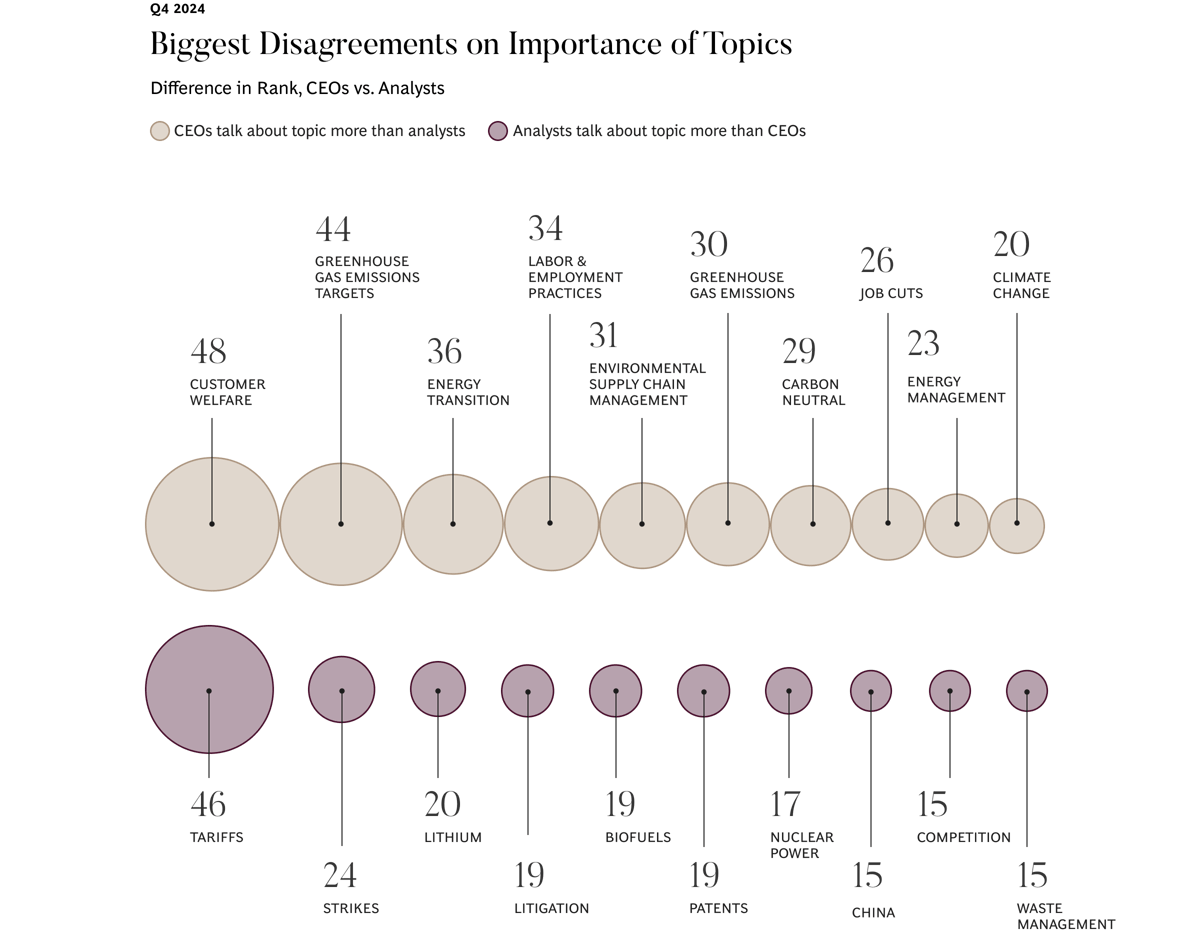

Ranks sixth for CEOs, but it barely makes the top 15 topics for analysts.

Tax Rates

Ranks ninth for CEOs, but just 20th for analysts.

Competition

Analysts’ top topic; it’s 16th for CEOs.

China

Comes in sixth place for analysts, while CEOs rank it 21st.