For decades, artificial general intelligence (AGI) — characterized by human-level reasoning, learning, and adaptation — was just a theory. Now, breakthroughs such as reasoning models, agentic AI, and multimodal systems are turning that future into a fast-approaching reality.

As machines increase their versatility in task execution and computing costs continue to fall, AGI seems to be stepping out of the future and into the present. Sustaining this momentum requires a tighter return on investment loop with measurable results so companies remain confident pursuing large-scale infrastructure investments. The ripple effects of these investments could reshape the wider tech stack, unlock generational investment opportunities across both AI infrastructure and applications, and set the stage for far-reaching technological disruptions.

The Trillion-Dollar Infrastructure Race Setting the Stage for AGI

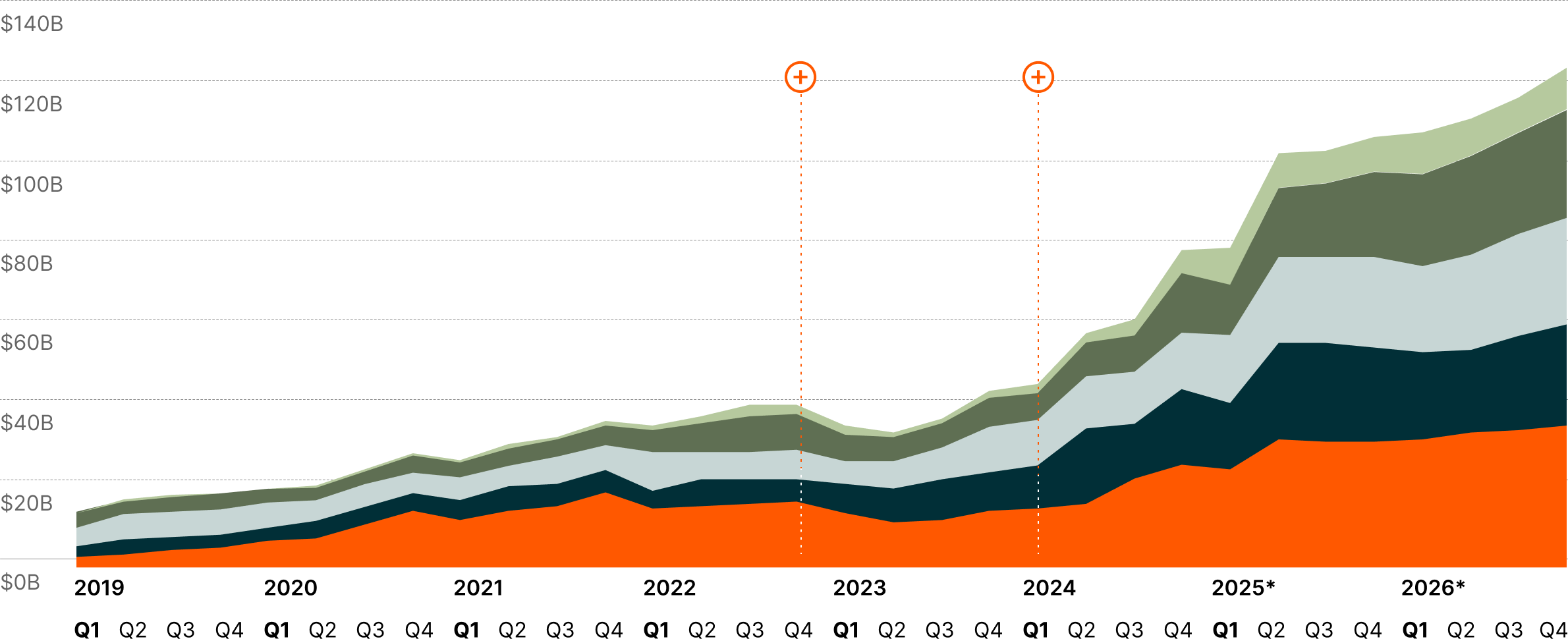

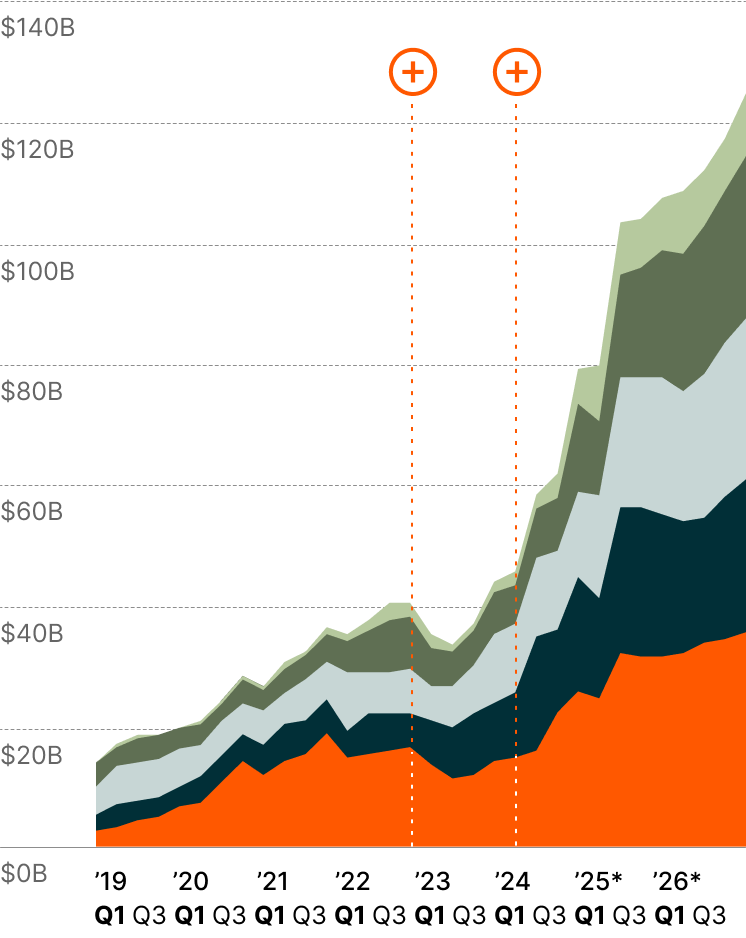

Three years after ChatGPT's groundbreaking debut, the AI transformation remains in its early stages and still requires trillions in investment. Hyperscalers expect to spend nearly half a trillion dollars on AI infrastructure in 2025 alone to accelerate their push into next-gen capabilities.1

Major initiatives reflect this momentum, such as the Stargate Project, which targets $500 billion in spending over the next four years.2 The scale of capital deployment signals a shift in how tech giants are approaching competitive differentiation in the AI era, and underscores the growing importance of advanced infrastructure to support next-gen models and training.

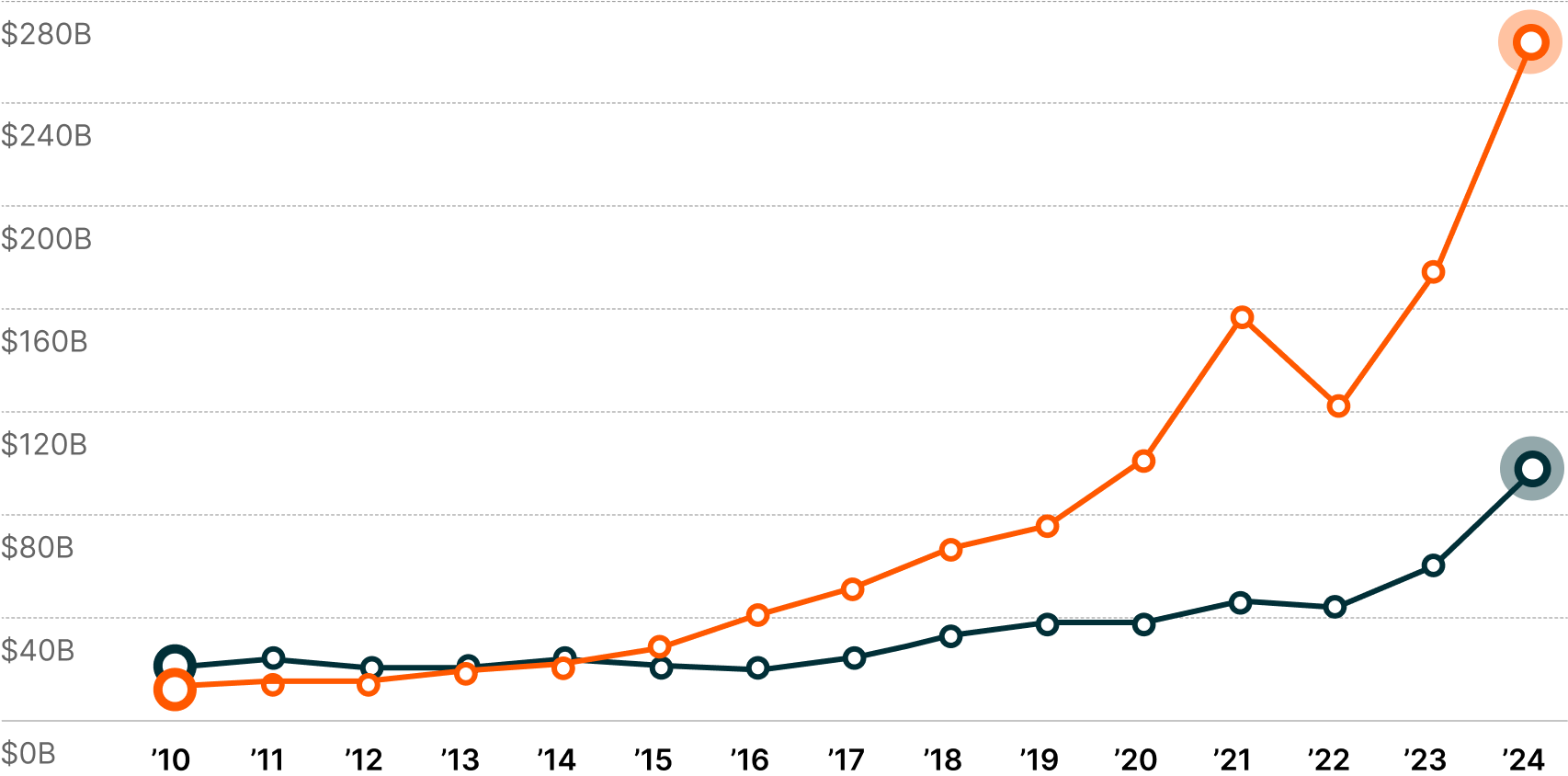

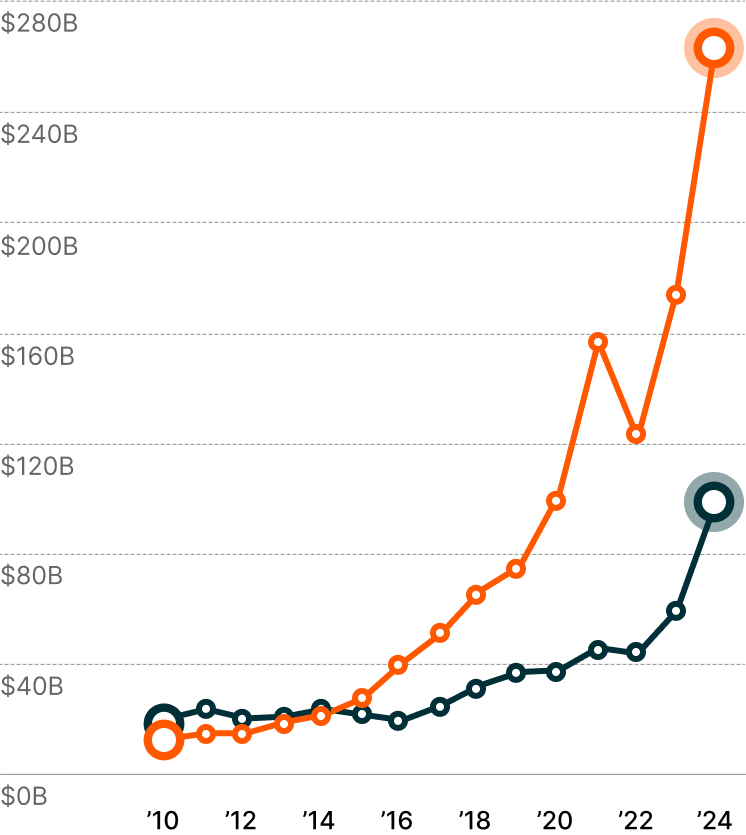

Top 5 Hyperscaler CapEx Spend3

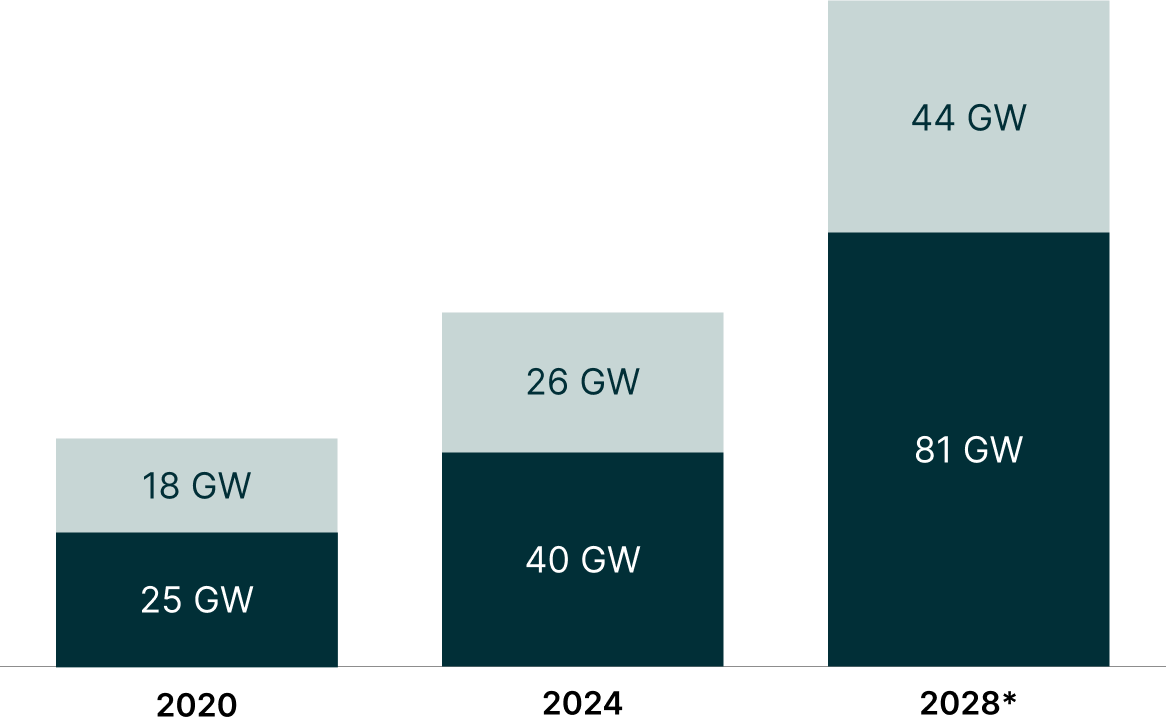

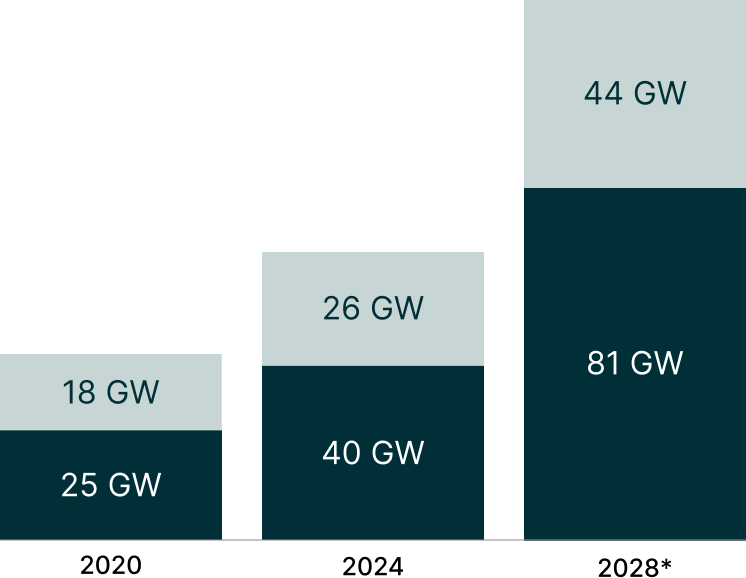

AI Data Center Buildout Is Going Global

The United States leads the global AI infrastructure buildout, accounting for 54% of total hyperscale capacity.4 But this technological transformation extends far beyond U.S. borders, as other nations increasingly recognize AI as critical to their economic and strategic competitiveness.

China, Europe, and other key regions are investing heavily to reduce reliance on foreign AI infrastructure, and to establish innovation hubs that support industrial automation, defense capabilities, and other strategic initiatives.

Global Data Center Power Demand5

GW = Gigawatts

The Future Is in the AI Application Layer

As the global AI infrastructure foundation takes shape, the question shifts to who captures the ultimate value. History shows a clear pattern: Hardware companies lead initial investment cycles, while software companies tend to capture most of the long-term value and profits.

The most sustainable competitive advantages derive from the interface layer, where users directly interact with groundbreaking technology. Today’s massive AI infrastructure investments lay the foundation for the software applications that can deliver on AI’s transformative potential.

Operating Profits by Industry Segment6

Amazon, Google, Meta, Netflix, Salesforce

AMD, Broadcom, Intel, NVIDIA, Qualcomm

EXPERT TAKEAWAY

“AI is on track to become the most impactful technology of our time. Breakthroughs in foundation models, agentic AI, and multimodal reasoning point to AGI being closer than ever before. As AI matures, its ripple effects will create new markets and redefine the economy, unlocking investment opportunities for decades to come.”