The technological shift reshaping the global economy stands on a foundation hidden in plain sight: critical minerals buried in the Earth’s crust. The rising adoption of disruptive technologies — AI data centers, renewable energy systems, electric vehicles, grid infrastructure, and defense tech — would be impossible without copper, lithium, rare earths, and other minerals that power the digital, electrified future.

Yet beneath this surge in technological innovation lies a brewing supply crisis driven by dwindling pipelines for new mines, lengthy development timelines, and highly concentrated supply chains. Forecasts show demand for these minerals rising sharply over the coming decades, widening the gap between supply and consumption.1 Mitigating the emerging risks from potential supply shortfalls will require significant investment in mineral production, processing, and battery technologies.

Electrification and AI Mineral Needs

The electrification of transport, heating, and other industrial processes has unleashed rising demand for critical minerals such as copper, lithium, and rare earth elements. For example, electric vehicles require six times more minerals than vehicles with traditional internal combustion engines.2

Growth in power generation and clean technologies could drive additional need for critical minerals, with cleantech’s share of total demand potentially increasing from 28% in 2024 to 41% in 2040.3 AI adoption could also boost needs globally, due to the minerals required for data centers’ physical structures and power needs.4

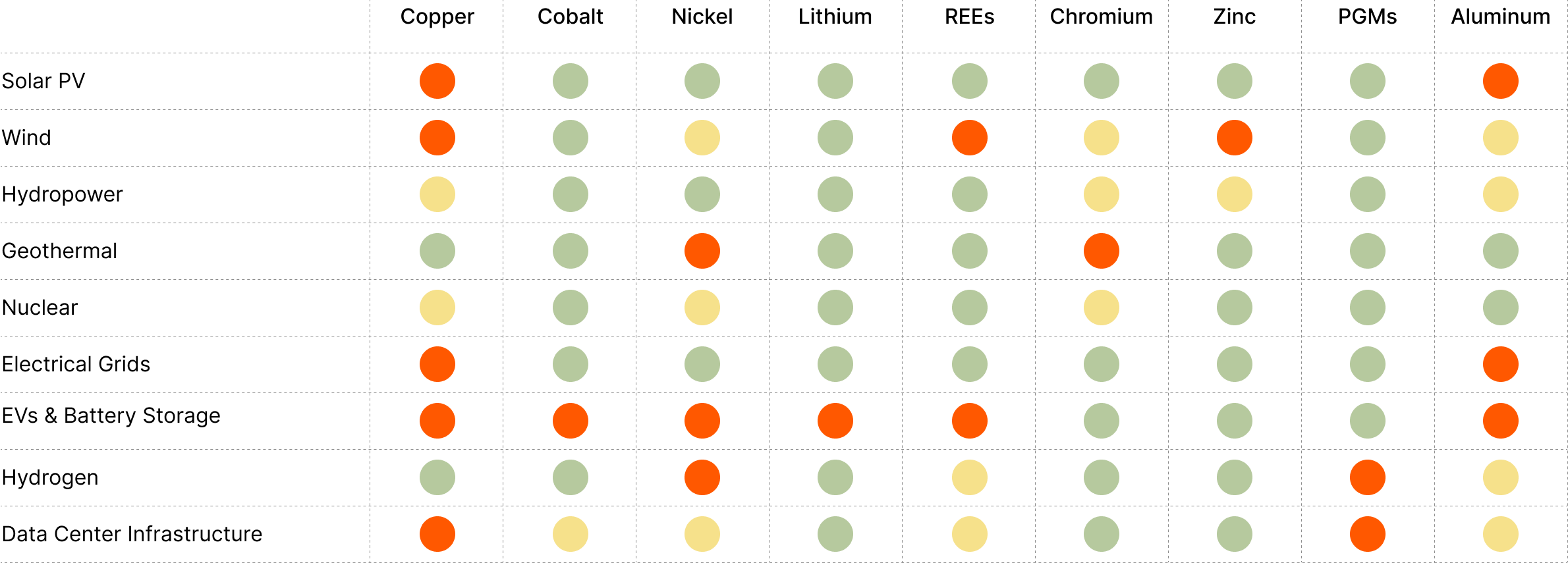

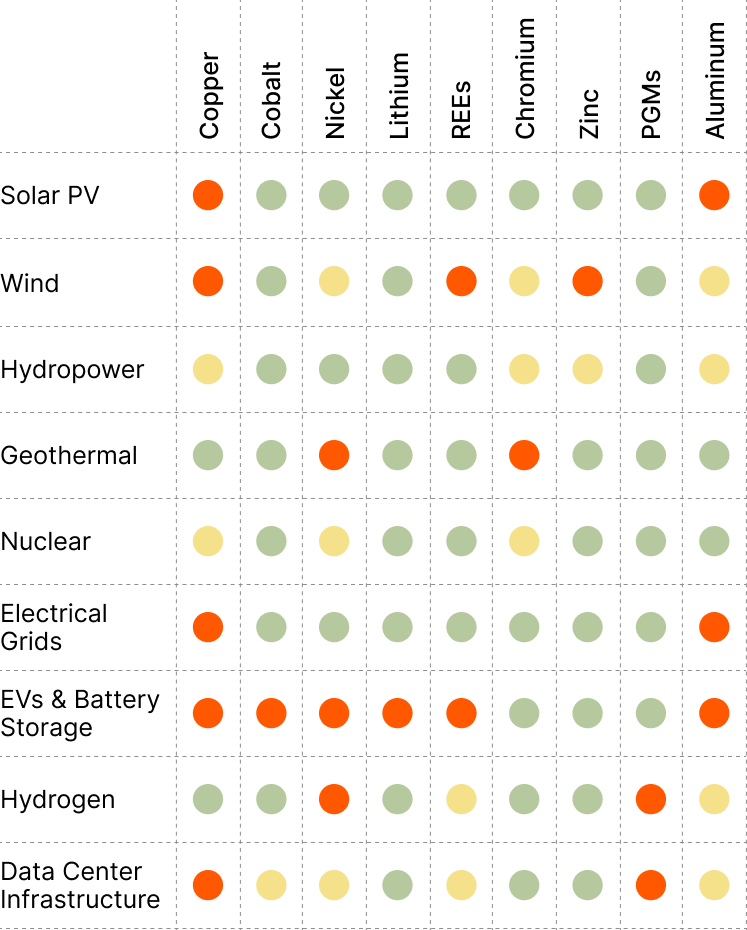

Critical Mineral Needs for Select Technologies and Infrastructure5

REEs = Rare Earth Elements

Mineral Shortages Risk Stalling the Tech Transition

Three main factors could constrain the global response to surging mineral demand: 1) sparse project development; 2) decades-long development timelines; and 3) highly concentrated supply chains.

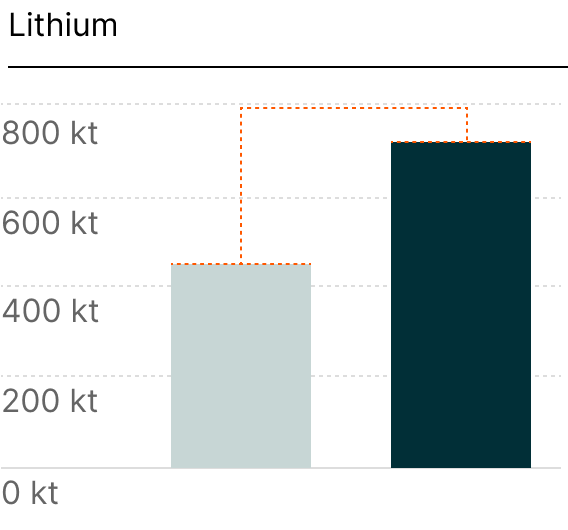

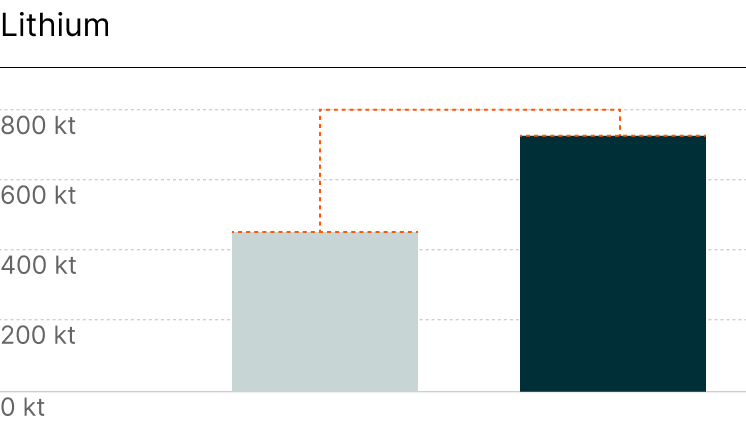

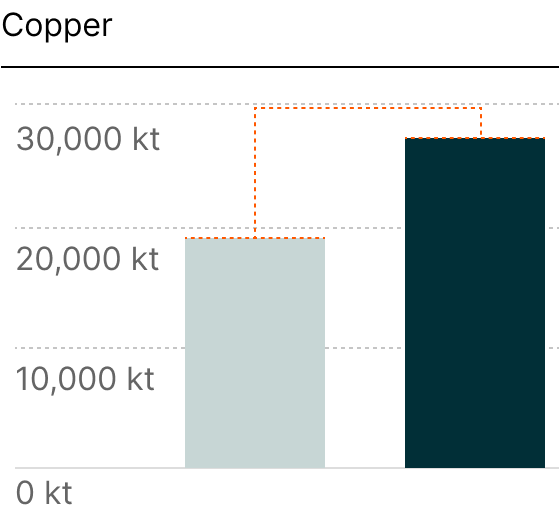

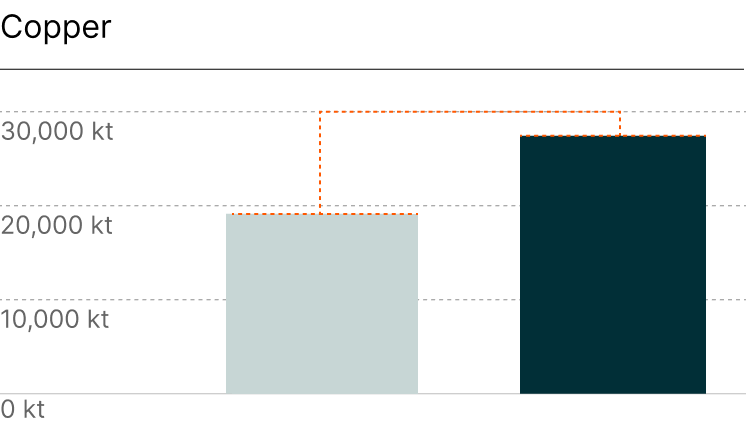

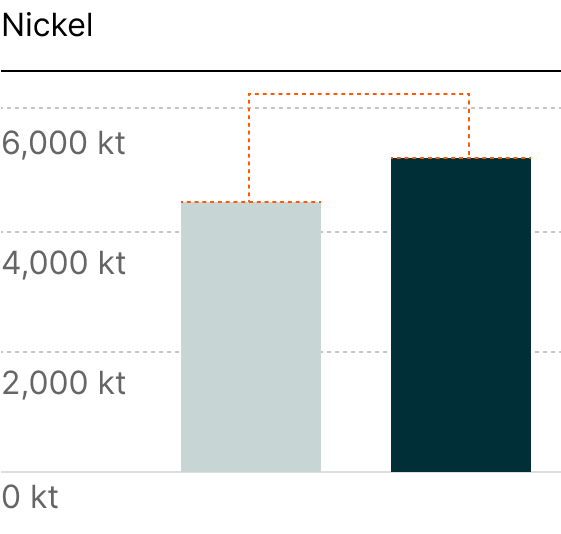

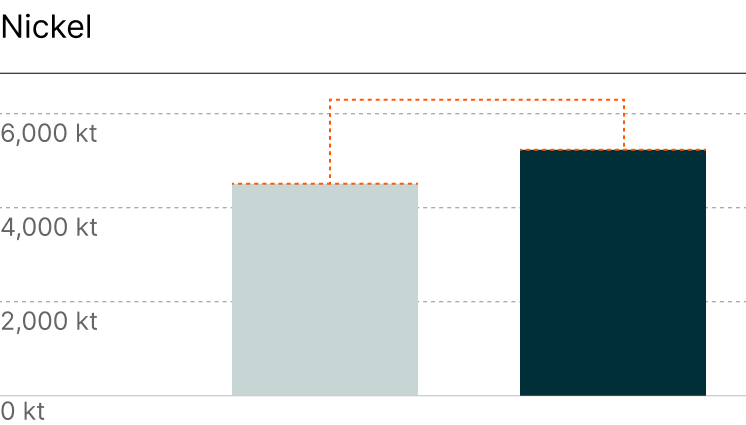

The scale of future demand defies precedent. For example, meeting projected needs may require mining 115% more copper than has been extracted throughout human history.6 Lithium demand could triple between 2024 and 2035, with battery applications forecast to account for 95% of future demand growth.7

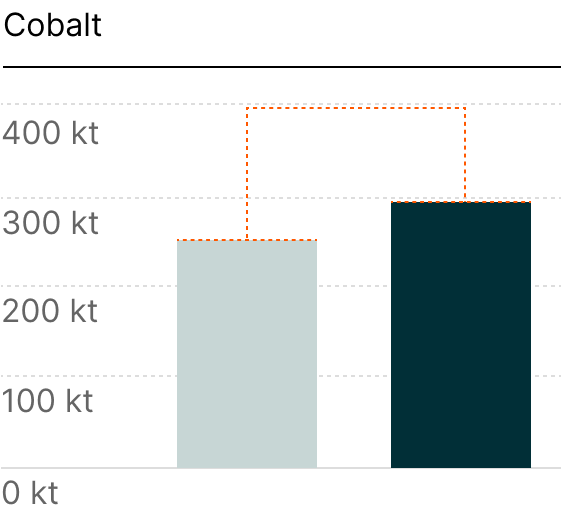

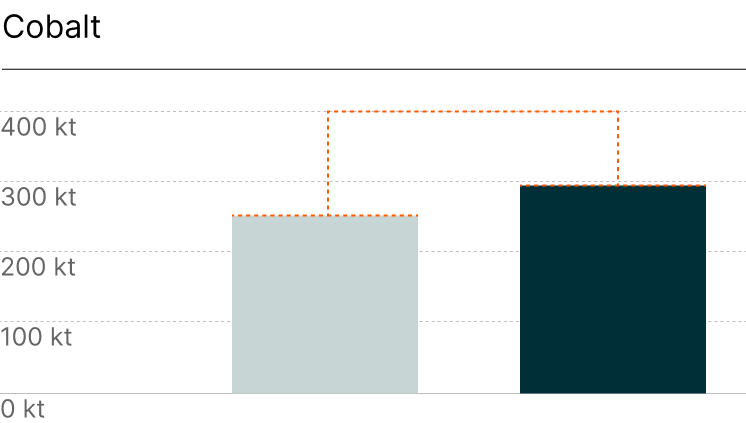

2035 Expected Mine Supply from Existing and Announced Projects & Primary Supply Requirements, by Material8

The Race to Mitigate Growing Supply Risks

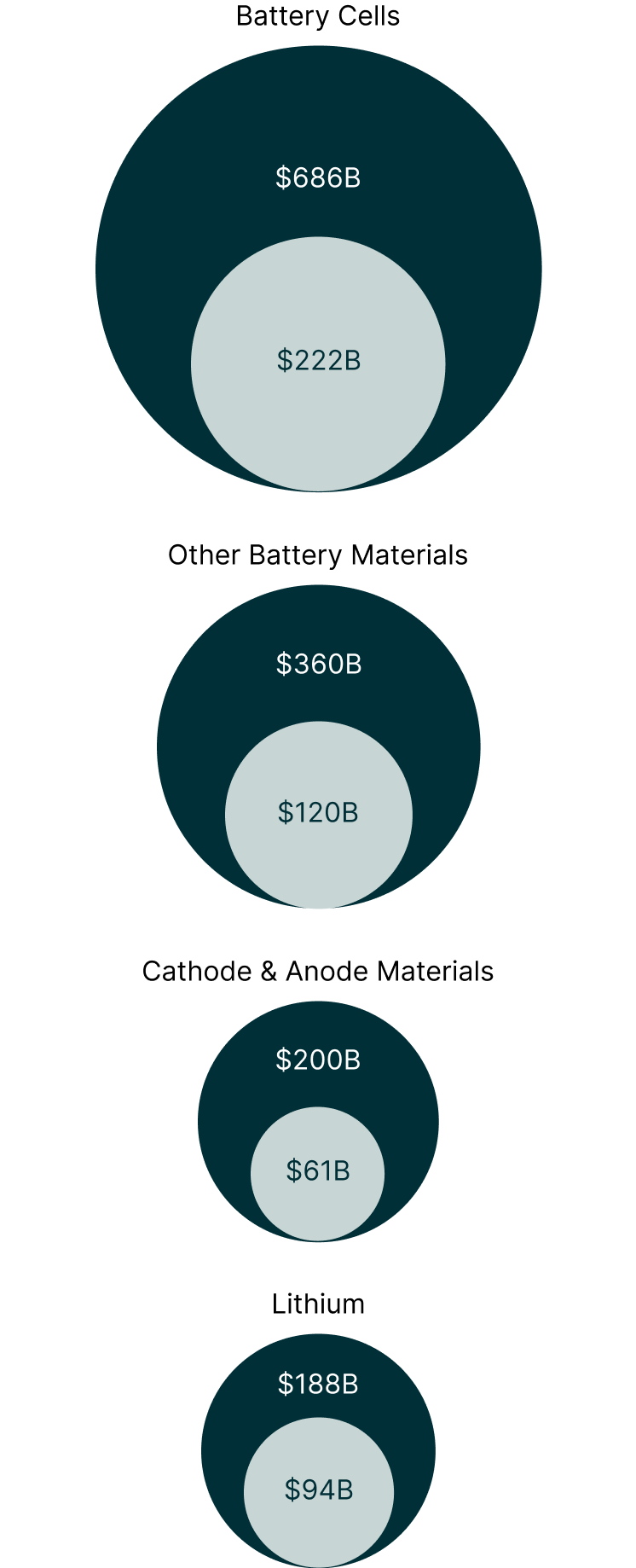

Addressing these supply constraints necessitates significant investment across multiple mineral supply chains, including mining, processing, and battery component manufacturing.9 Preventing shortfalls across just the EV battery supply chain could call for nearly $500 billion in investments by 2030, and more than $1.4 trillion by 2040.10

However, potential opportunities extend beyond the lithium battery supply chain to include other minerals essential for renewable energy, AI adoption, and defense applications. For example, the investment challenge is particularly acute for silver: Only 22% of 2024 silver supply derived from dedicated silver mines, with the majority arising as a by-product of recycling or other metals’ production, severely limiting the industry’s ability to scale quickly.11 With electronics applications growing 71% over the past decade, silver consumption continues to intensify.12 The magnitude of required investment suggests that mineral supply security could become as strategically important as energy security.

Investments Needed in Lithium Battery Supply Chain to Fill Shortfall Estimates by 2030 and 204013

EXPERT TAKEAWAY

“Critical minerals are the backbone of an electrified future. From infrastructure expansion to power generation and AI data centers, these materials and the supply chains behind them are essential to fueling the next wave of global innovation.”