Global power demand is poised for a dramatic transformation. The convergence of generative AI and electric vehicle (EV) adoption is fundamentally reshaping electricity consumption patterns through the proliferation of power-hungry data centers and expansive charging infrastructure. The simultaneous acceleration of manufacturing reshoring is compounding electricity needs, as utilities face mounting energy security challenges and grid modernization demands.

These trends manifest most notably in major economies, such as the United States, where substantial growth in data centers, EVs, and manufacturing is causing a sharp increase in power demand after two decades of near-stagnation.1 Meeting these challenges calls for large-scale deployment of available technology, including nuclear power, renewables, cutting-edge energy storage systems, and hydrogen-powered solutions.

The Global AI Power Crunch

By 2040, global electricity demand is forecast to increase by

50% or

13,300 TWh4

The scale of AI’s electricity needs continues to expand. A single ChatGPT query requires approximately 10 times the energy of a typical Google search, while data centers could consume greater than 3% of the world’s electricity by 2030, up from 1.5% in 2024.2 But it’s not just AI adoption driving global power demand. Electrification of transport and heating, expanding manufacturing activity, and rising use of air conditioners and other appliances also contribute to increasing global power needs.

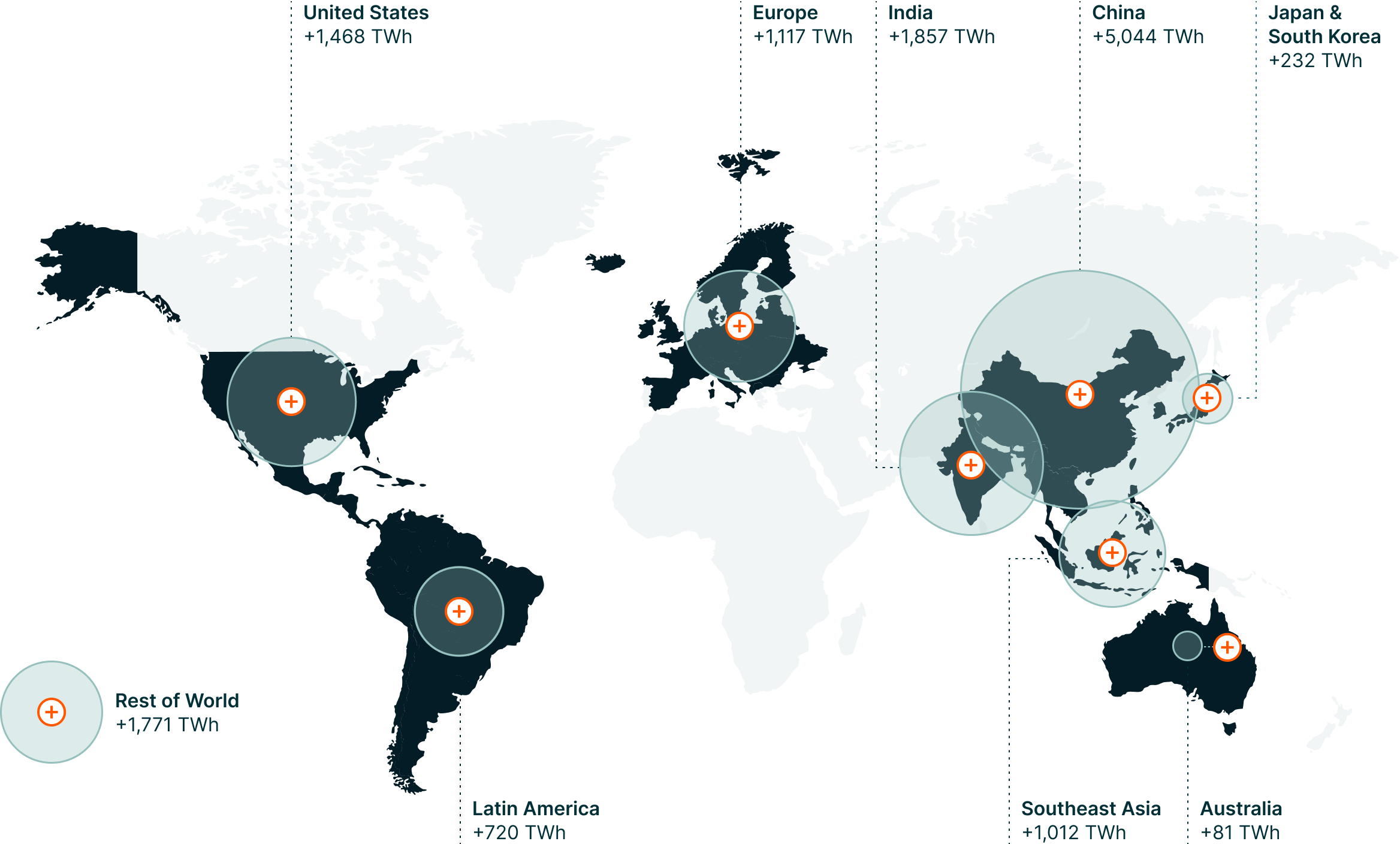

China, India, and the United States lead the surge, with forecasts predicting these three countries to account for nearly two-thirds of global power demand growth between 2025 and 2040.3 This trend extends to many other economies that must also support advanced technologies and digital infrastructure.

By 2040, global electricity demand is forecast to increase by

50% or

13,300 TWh4

Electricity Demand Growth, 2024–20405

All-Out Investment Is Needed to Power the Future

Meeting surging demand while also maintaining energy security and achieving climate objectives calls for broad-based capital allocation across the entire power ecosystem. Potential solutions include nuclear power, renewable energy systems, energy storage, and hydrogen, as well as advanced grid technologies and infrastructure.

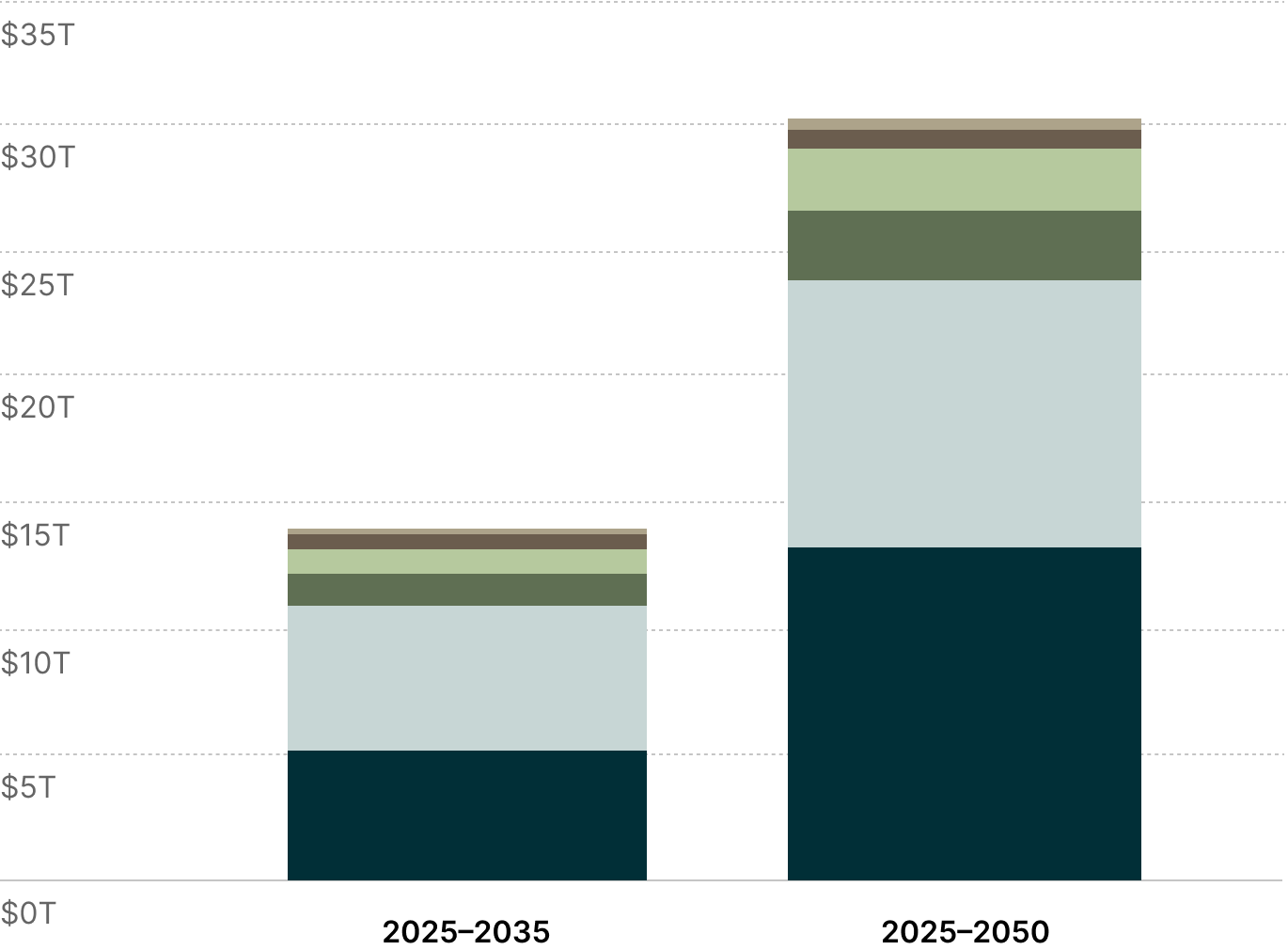

Satisfying rising electricity needs while reducing emissions could require nearly $15 trillion in investments through 2035.6 Recent geopolitical disruptions have further highlighted electricity supply vulnerabilities, accelerating investment in technologies that boost domestic power production and reduce dependence on volatile global markets.

Global Investment Requirements Under the Economic Transition Scenario7

Nuclear Is Key to Power Abundance

Growing power demand and rising geopolitical supply risks could create new and varied opportunities throughout the power sector. The advent of AI and global electrification has reignited interest in nuclear power, led by tech companies that require vast amounts of reliable, carbon-free electricity.

The recent proliferation of power purchase agreements (PPAs) between hyperscalers, nuclear utilities, and reactor developers highlights growing private-sector support for nuclear power. At the same time, public policy support remains critical to expanding nuclear power capacity worldwide.

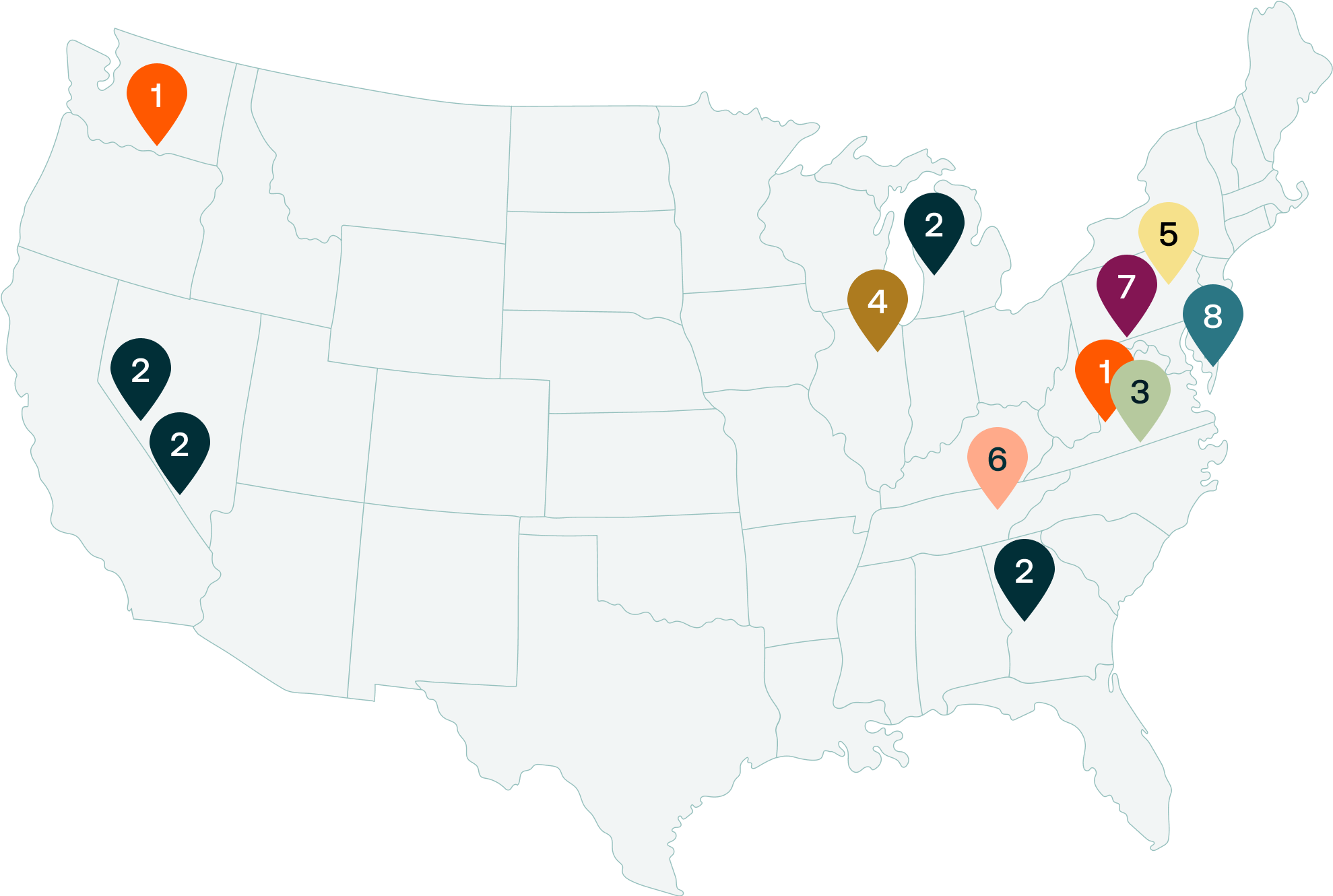

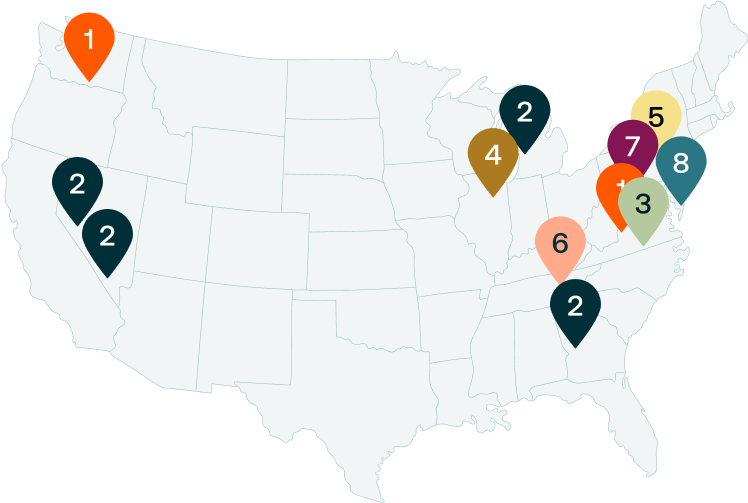

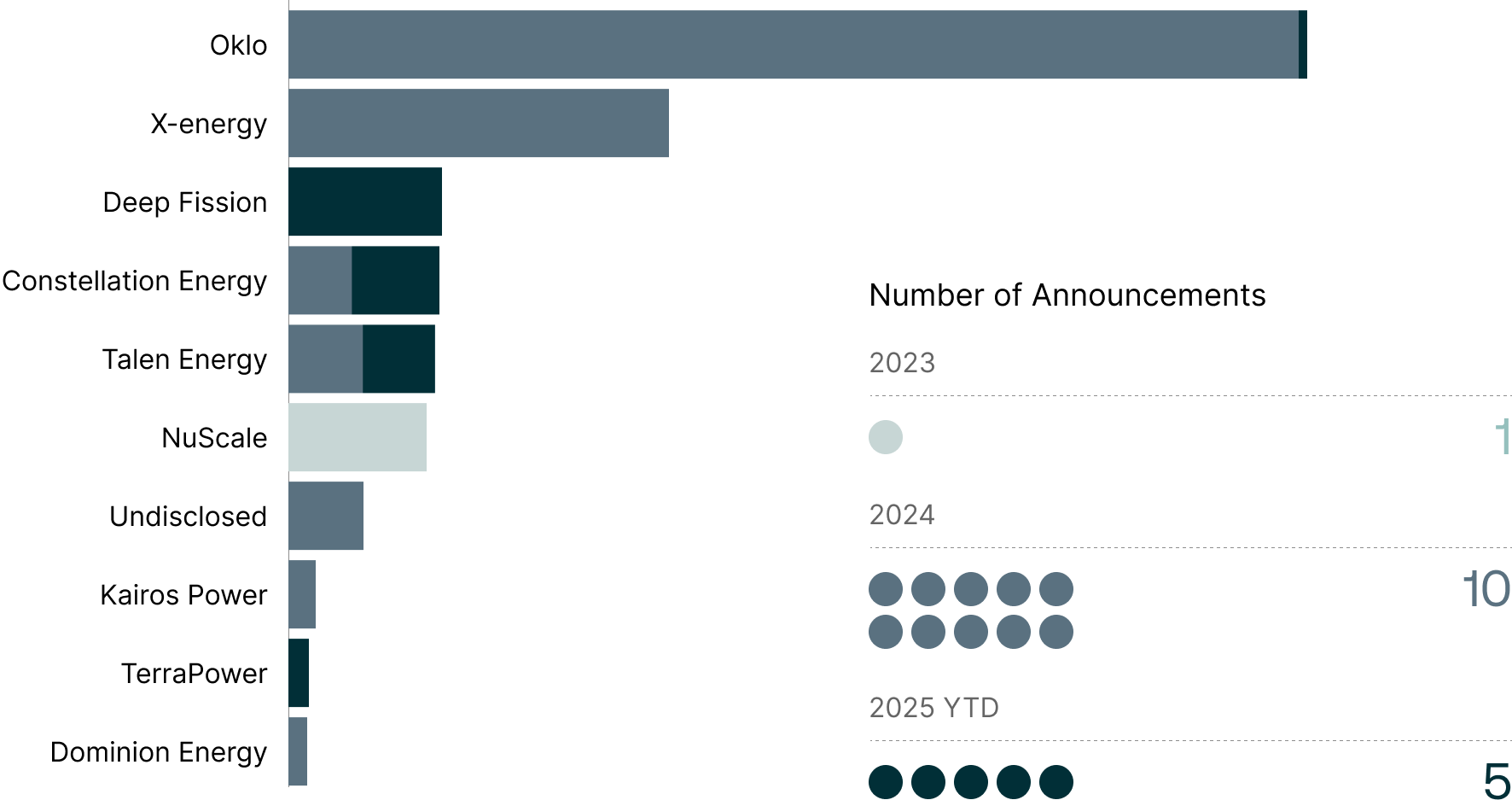

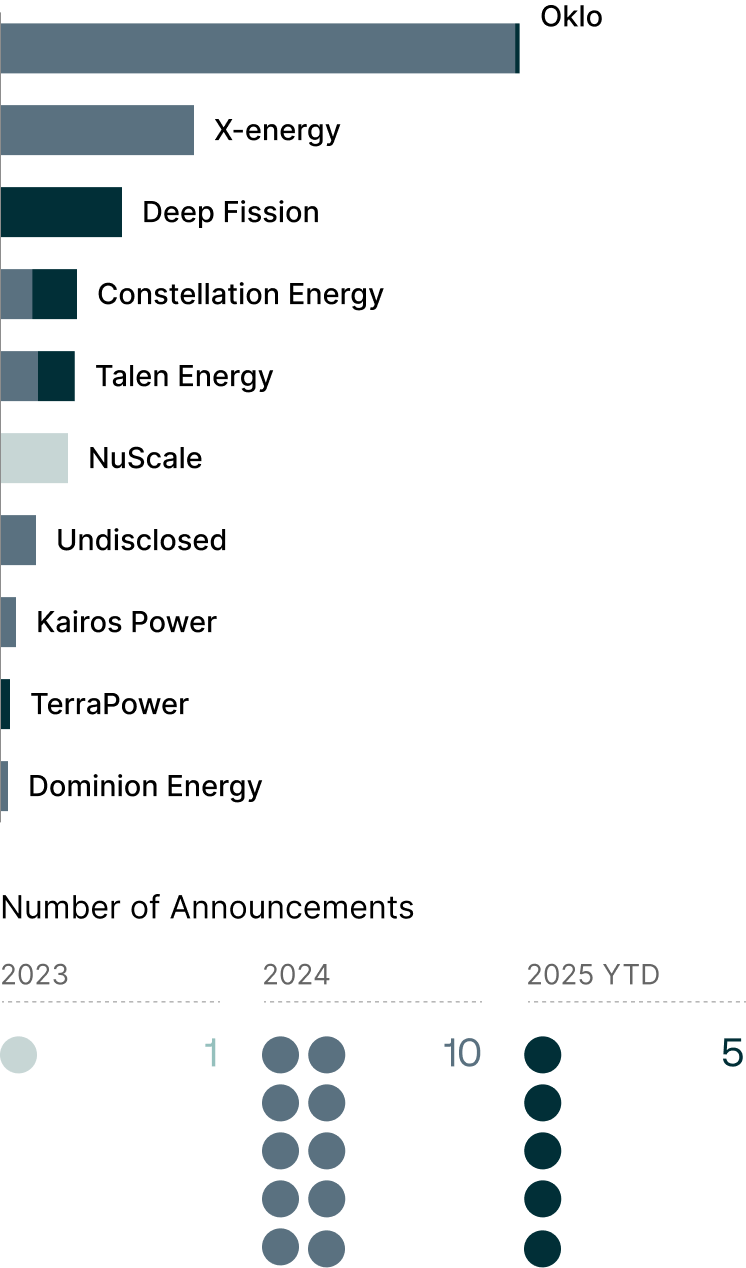

Select PPAs Between Hyperscalers, Nuclear Utilities, and Reactor Developers8

U.S. Nuclear Partnership Agreements9

EXPERT TAKEAWAY

“Generative AI, EVs, and the manufacturing boom all hinge on one thing: power. Meeting this demand will require a diversified approach — from nuclear power to renewables — to secure the electricity backbone of global growth.”

CASE STUDY

Centrus Energy

Small modular reactors powered by advanced nuclear fuels offer a promising solution to meet rising U.S. energy needs.

Small modular reactors powered by advanced nuclear fuels offer a promising solution to meet rising US energy needs.