Powerful generational tailwinds are propelling a global transformation of the built environment, driven by urgency and accelerating innovation. The rapid integration of disruptive technologies such as generative AI, renewable energy systems, and electric vehicles sets the stage for a new era of global infrastructure development. These forces reveal both the vast scale of unmet infrastructure needs and the growing vulnerabilities of aging systems.

The scale is staggering: Nearly half of the buildings that will need to exist globally by 2050 have yet to be constructed.1 However, significant challenges complicate this historic, opportunity-rich construction pipeline, including population growth and urbanization, climate-driven infrastructure demands, and supply bottlenecks in developed economies.

Converging Forces Accelerate Infrastructure Development

Global fragmentation, aging infrastructure assets, and shifting demographics are reshaping investment priorities as nations modernize existing resources and expand domestic capabilities. At the same time, climate change and technological disruption are driving demand for sustainable infrastructure, from renewable energy and smart grids to EV charging and energy storage.

In 2024, extreme weather caused $402 billion in damages, underscoring the need for climate-resilient systems.2 Meeting global development and climate goals through 2030 requires $6.9 trillion in annual infrastructure investment, including trillions for power grid upgrades to support electrification, AI, and clean energy growth.3

Structural Trends and Their Corresponding Infrastructure Needs4

Clean Water Infrastructure

Power Grids

Roads

Tunnels

Wastewater Infrastructure

Housing

Power Grids

Retail

Roads

Wastewater Infrastructure

EV Chargers

Smart Grids

Power Plants

Production Facilities

Renewable Energy

Energy Storage

EV Chargers

Power Grids

Power Plants

Renewable Energy

EV Chargers

Green Buildings

Power Grids

Sea Walls

Smart Grids

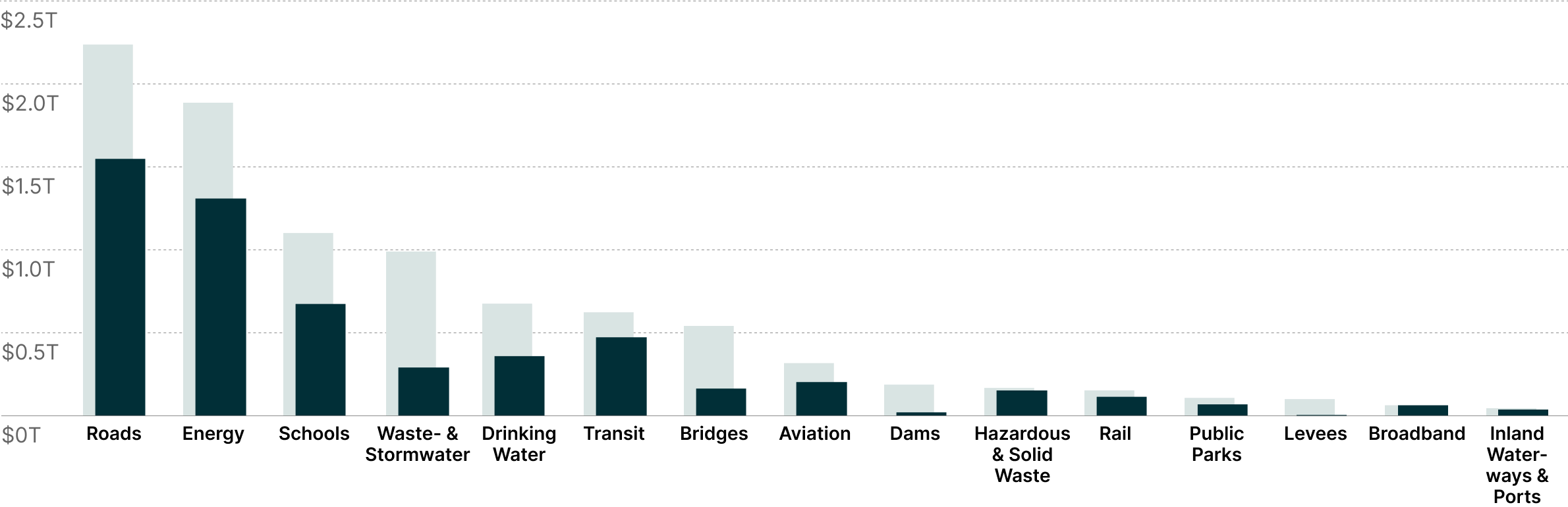

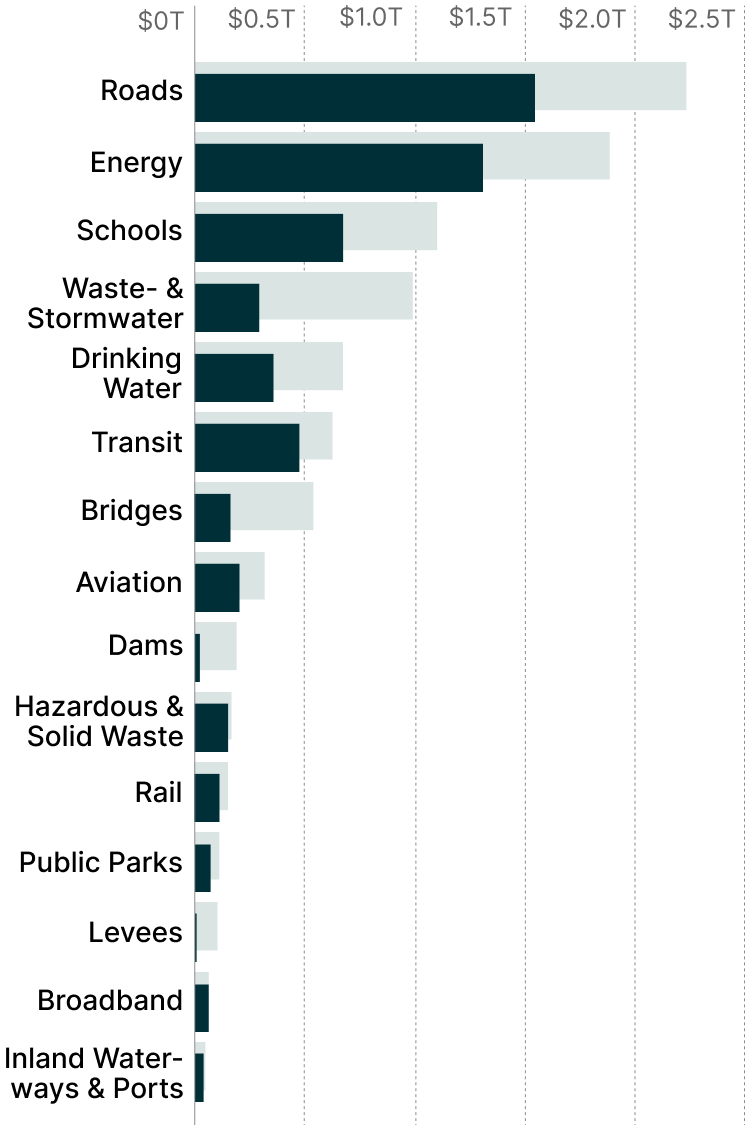

The $9 Trillion U.S. Investment Opportunity5

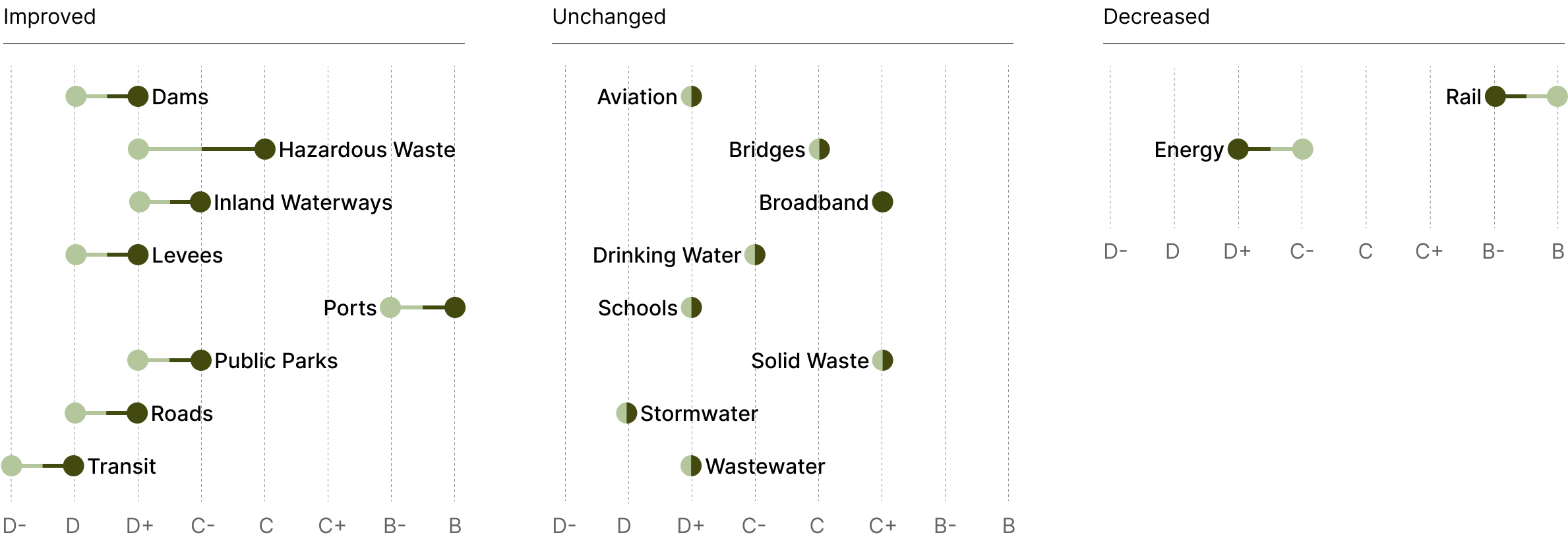

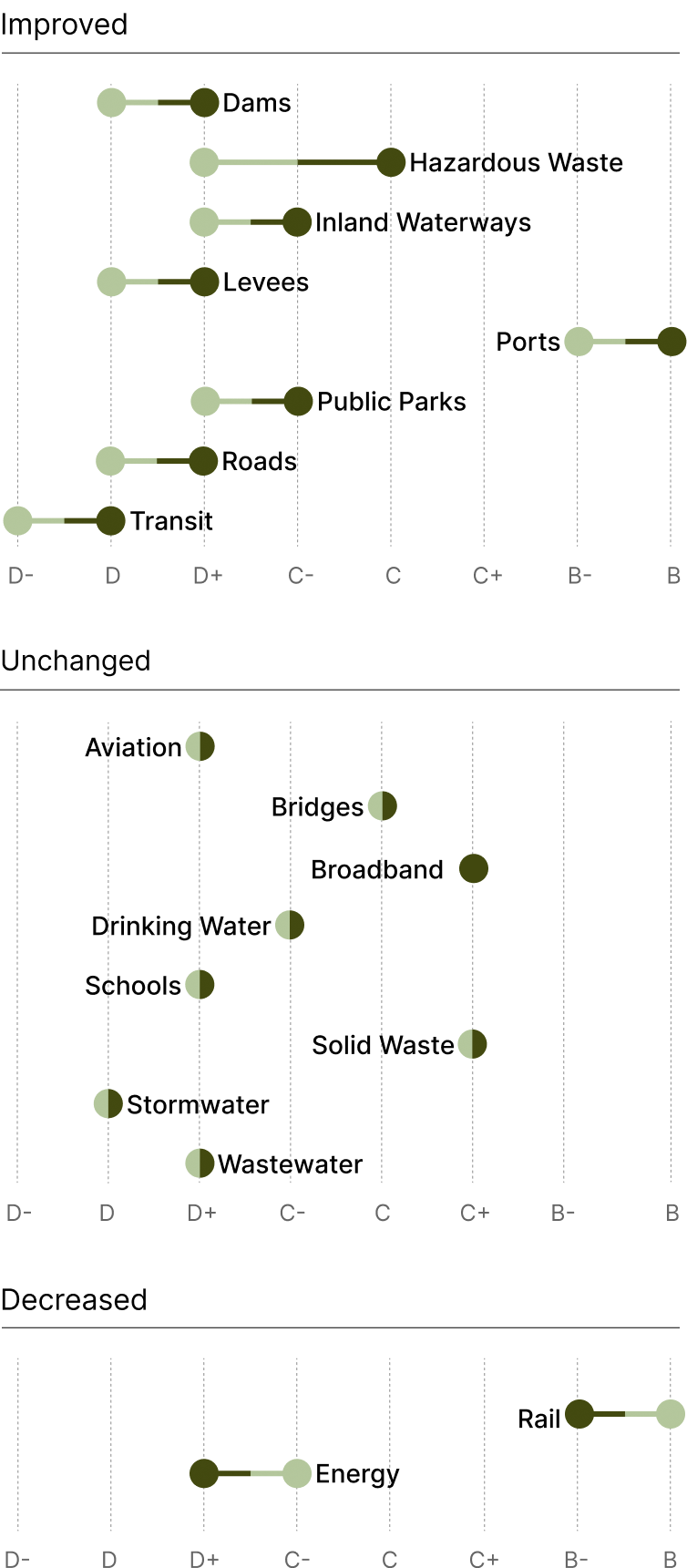

The United States continues to face significant infrastructure deficiencies. In 2025, the American Society of Civil Engineers (ASCE) raised the country’s overall infrastructure grade to a C, from C– in 2021.6 This reflects progress following recent investments, but a C grade from the ASCE still translates to “Mediocre, Requires Attention,” indicating notable deterioration and deficiencies.7 Nearly half of the assessed categories — including energy, aviation, and transit — received a grade in the D range. To adequately improve, modernize, and maintain critical systems, an estimated $9.1 trillion in investments will be needed through 2033.8

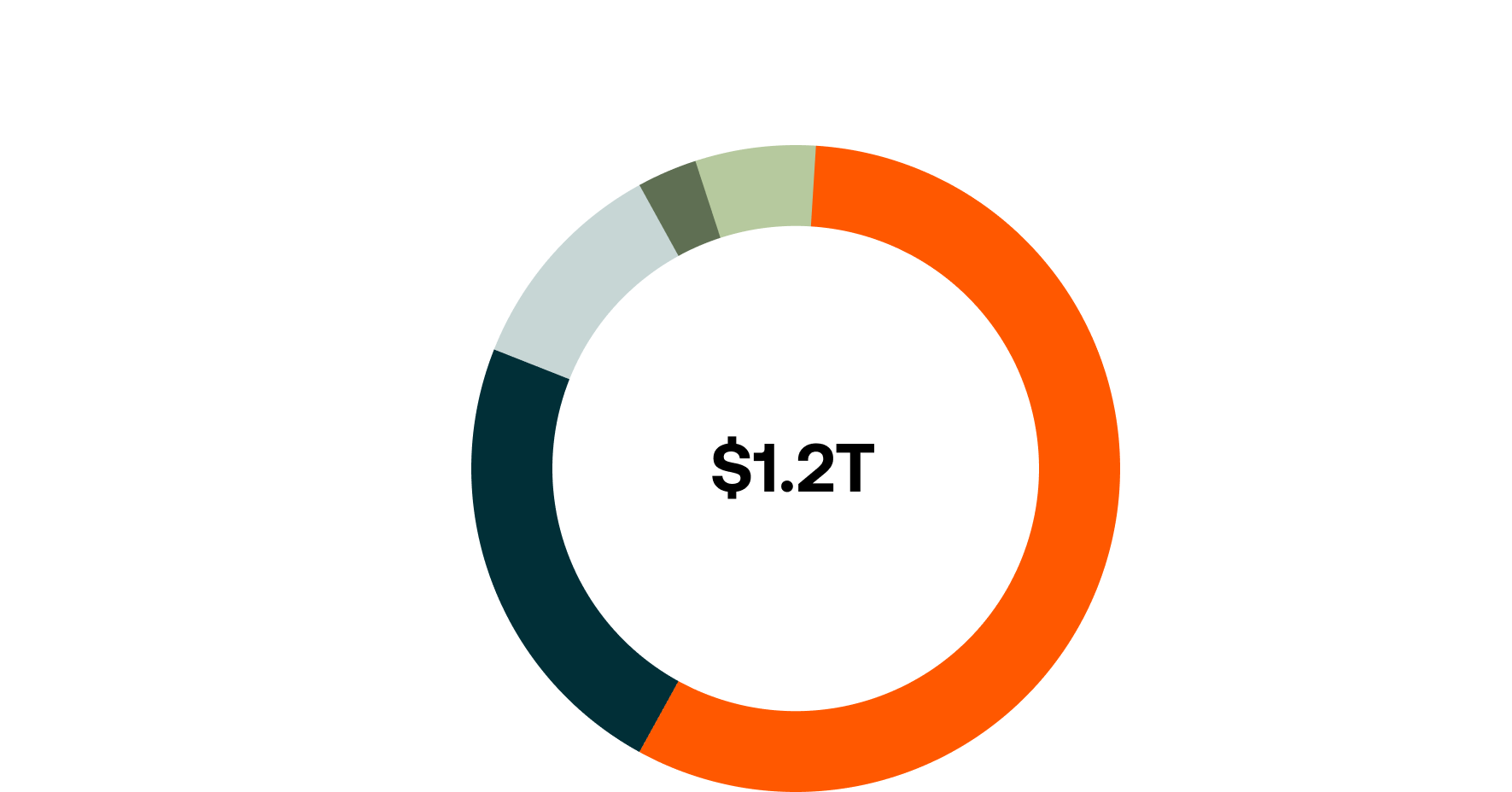

U.S. Cumulative Investment Needs by Infrastructure Category9

Grade Change10

The U.S. Manufacturing Investment Boom

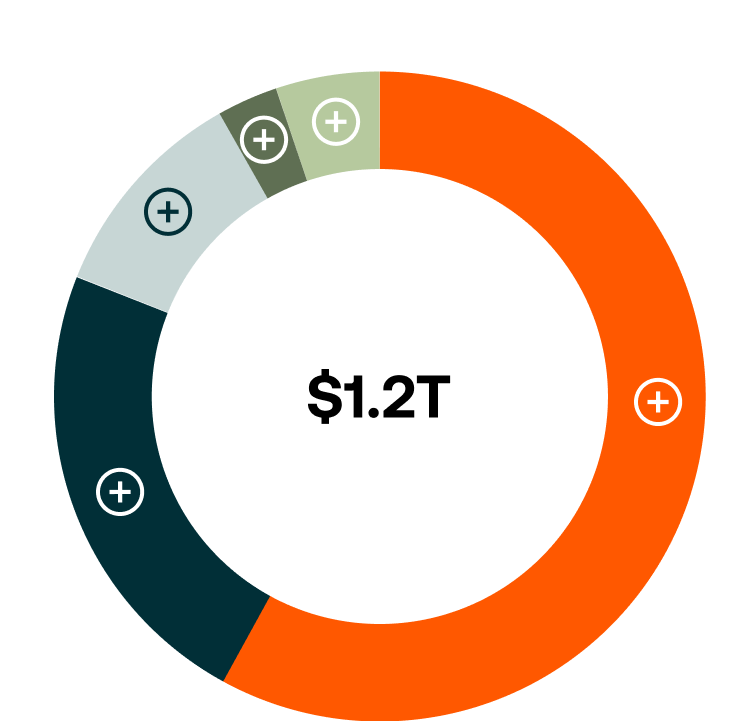

The ongoing manufacturing surge across the United States creates compelling opportunities but also increases demands on the nation’s physical systems. Between January and mid-September 2025, companies announced over $1.2 trillion in investments to expand U.S. production capacity, with a strong focus on semiconductors, consumer electronics, and pharmaceuticals.11

Notably, major pharmaceutical corporations committed more than $200 billion to bolster domestic supply chains.12 Such investments fuel a virtuous cycle, driving much-needed infrastructure upgrades across the country.

Share of Total Announced U.S. Manufacturing Investments in 2025, by Industry13

EXPERT TAKEAWAY

“Global infrastructure development could soon reach a critical juncture, as technological innovation, population growth, and extreme weather risks demand more from the built environment. Opportunities are expanding worldwide, with infrastructure needs spanning traditional assets, such as roads, to next-gen assets, such as AI data centers and modernized power grids.”